Redesigned the Cards Hub with Digital Instant Issuance to enable faster, safer card access and reduce customer support dependency.

Company

Westpac

Timeline

2023

—

2024

Role

Lead UX Designer

Problem & Opportunity

The Challenge

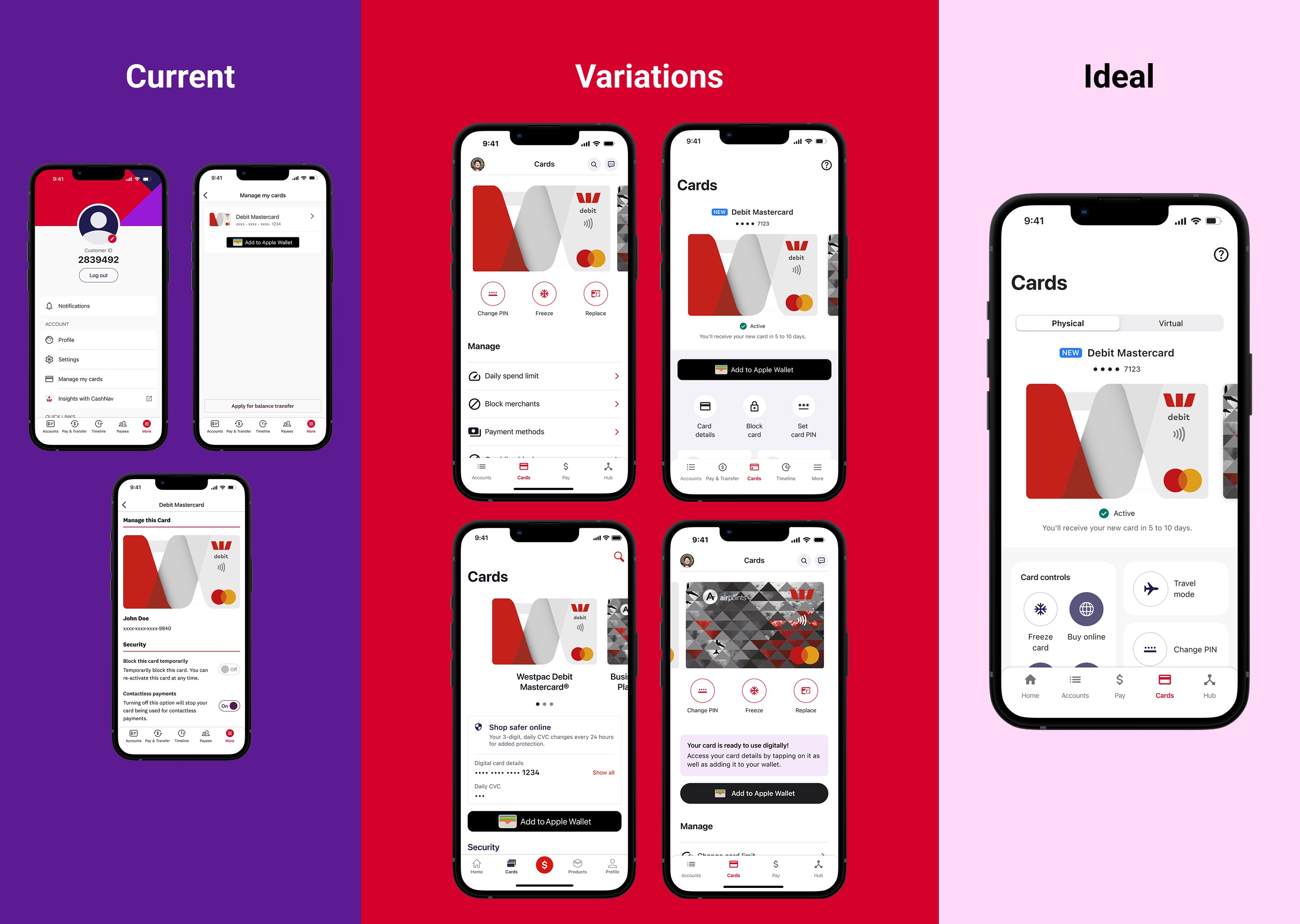

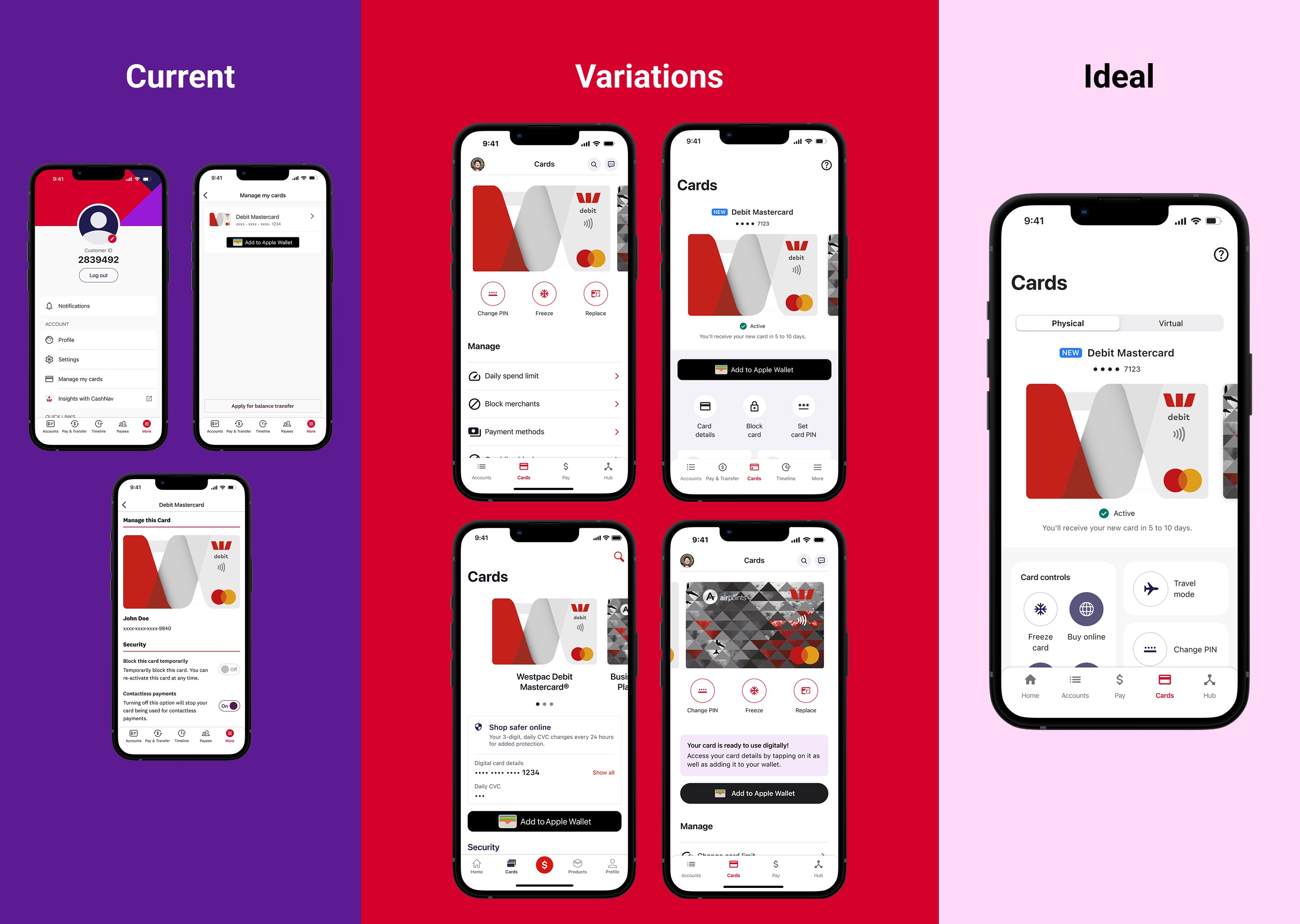

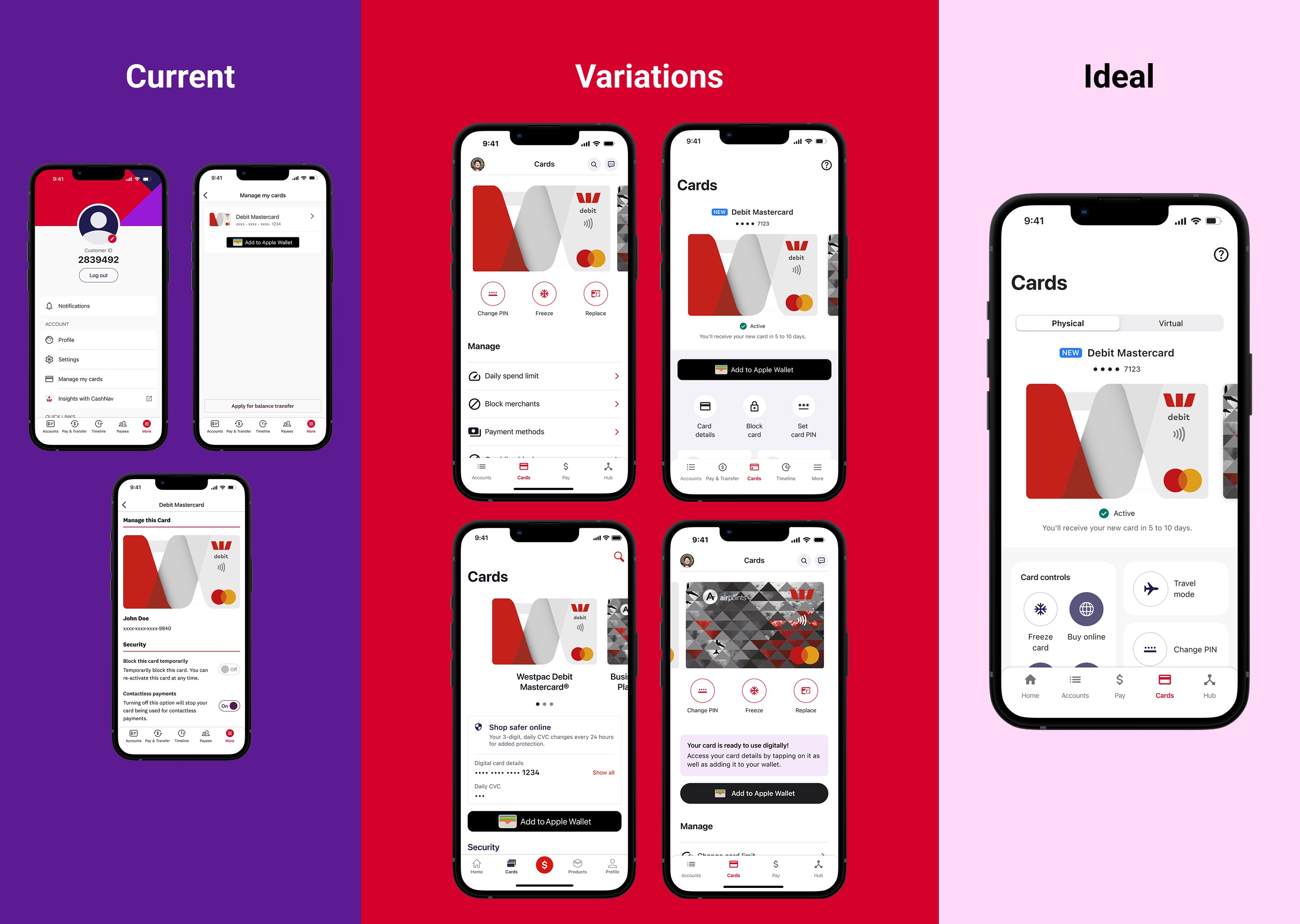

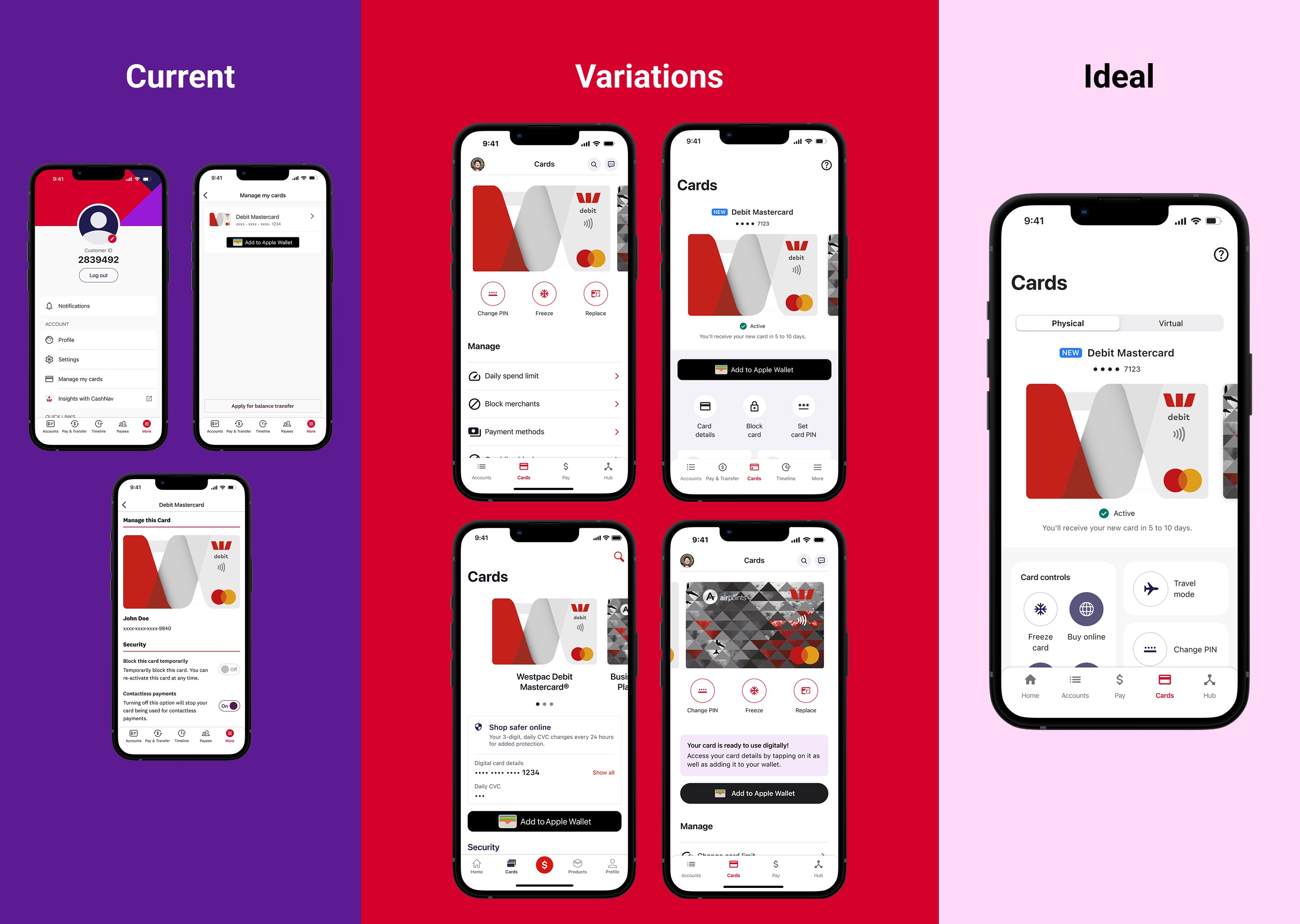

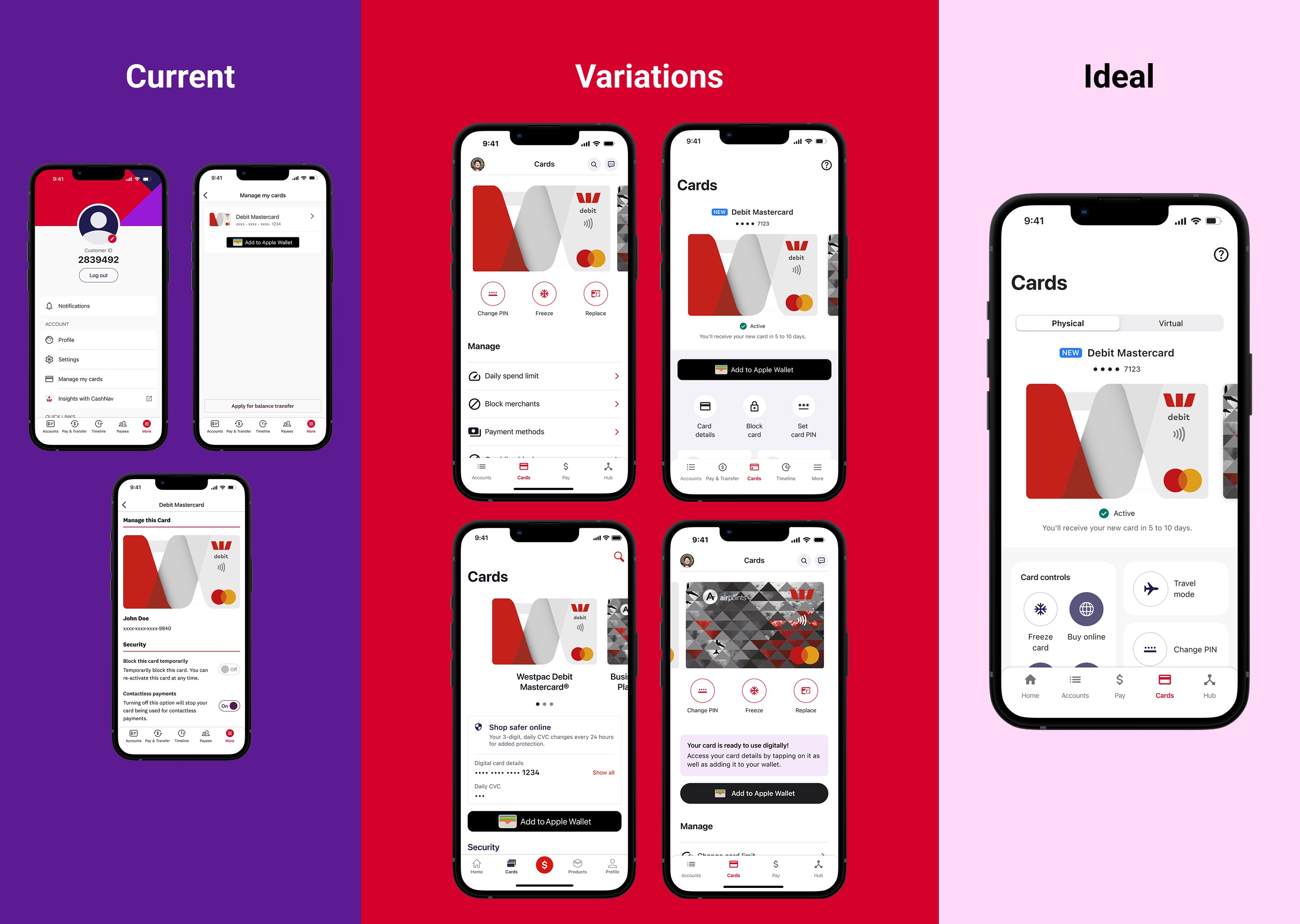

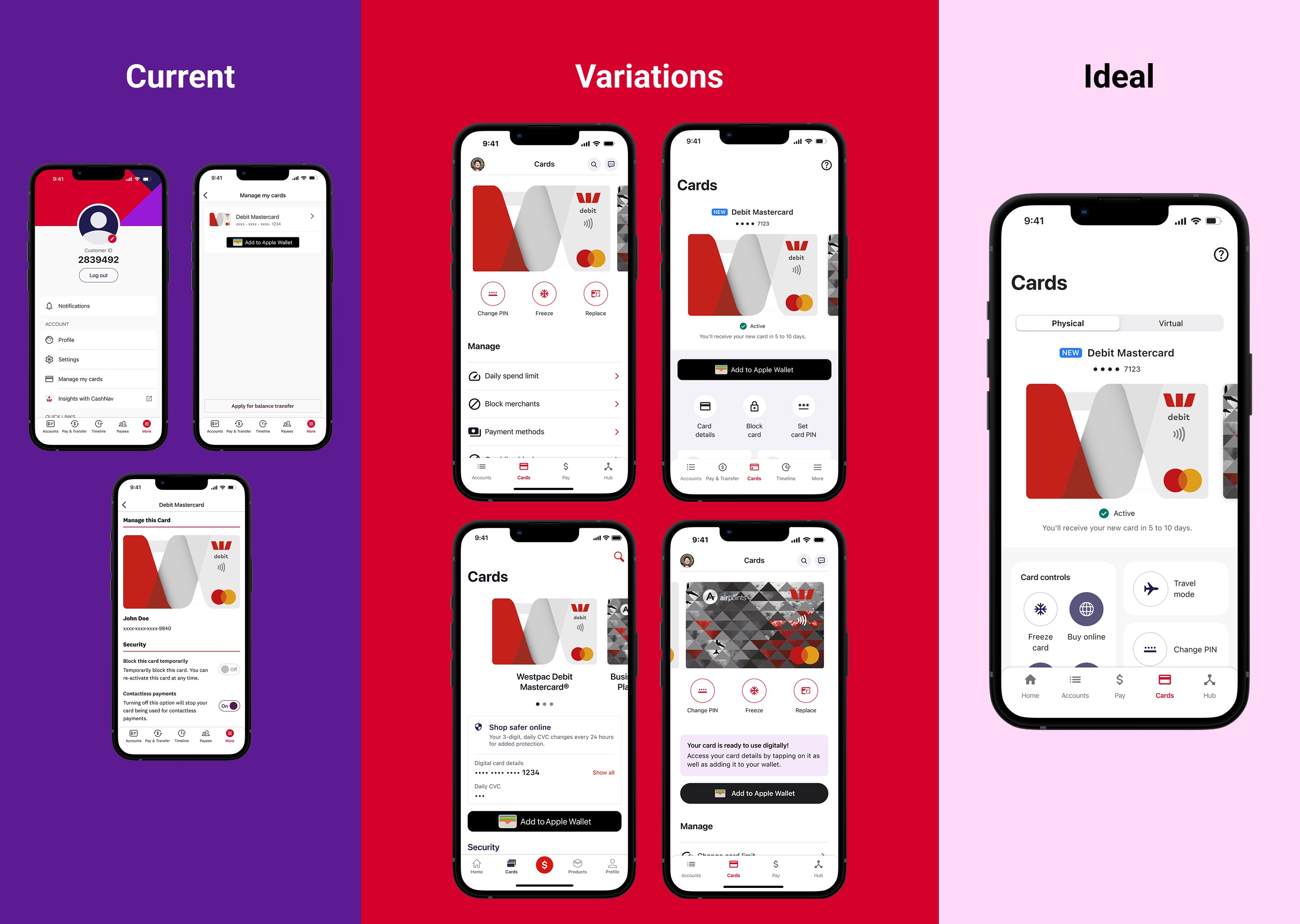

Cards Hub discoverability

Card controls were buried under the More navigation and implemented as a web view

Customers needed multiple taps just to reach basic card management actions

Delayed physical cards

New customers waited up to 10 working days for a physical card

During this period, customers couldn’t shop online and were exposed to scam risks

Business Impact

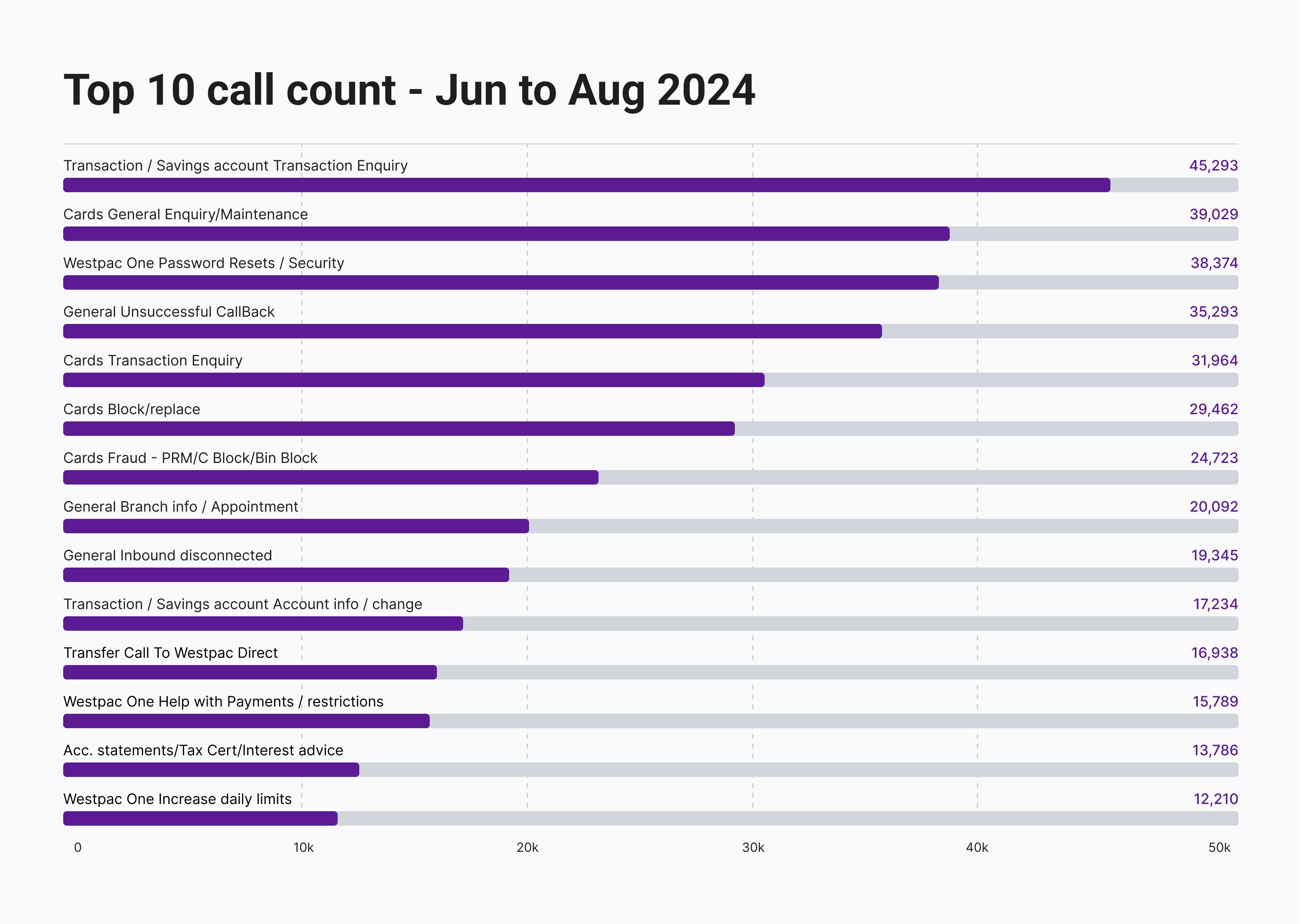

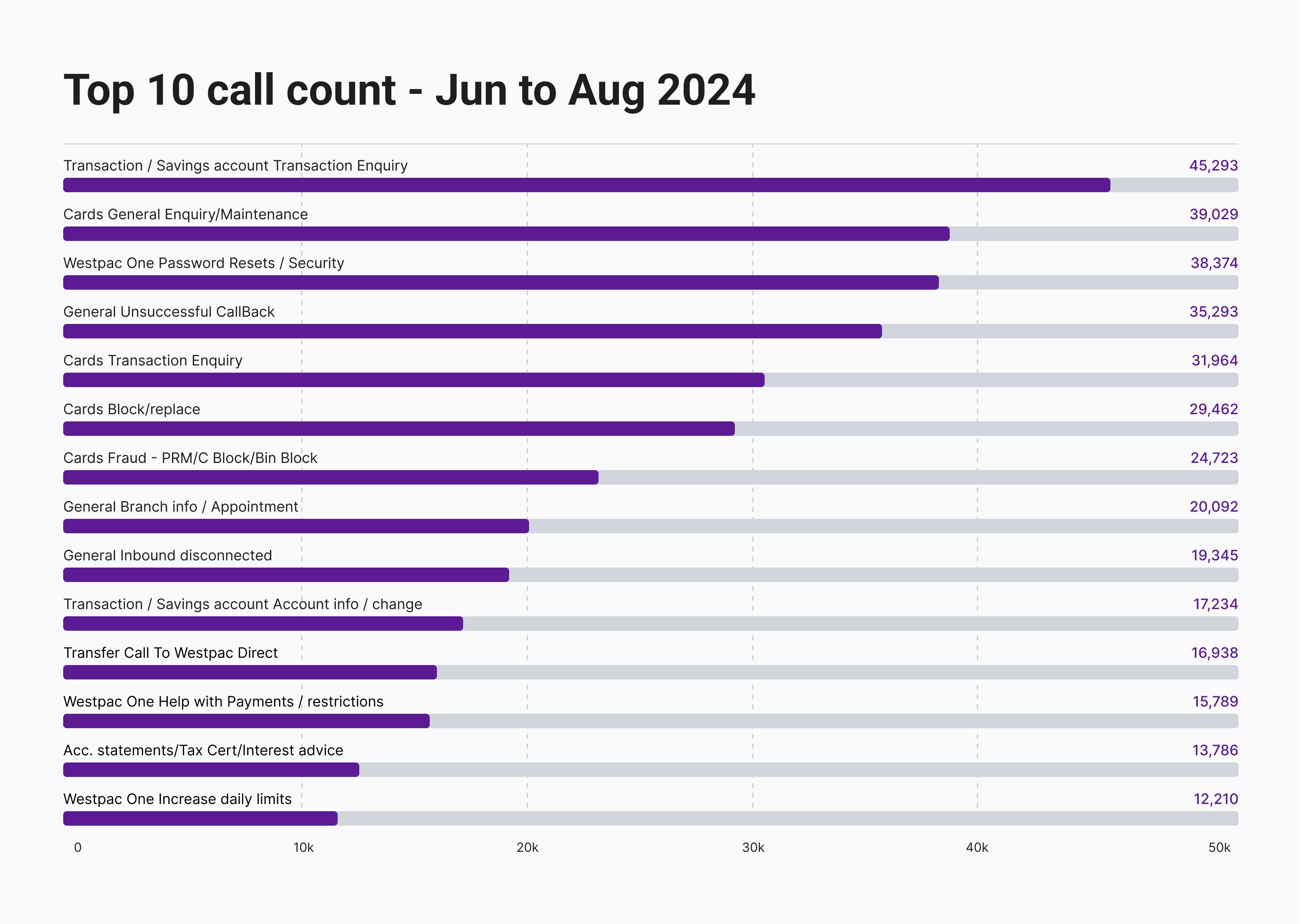

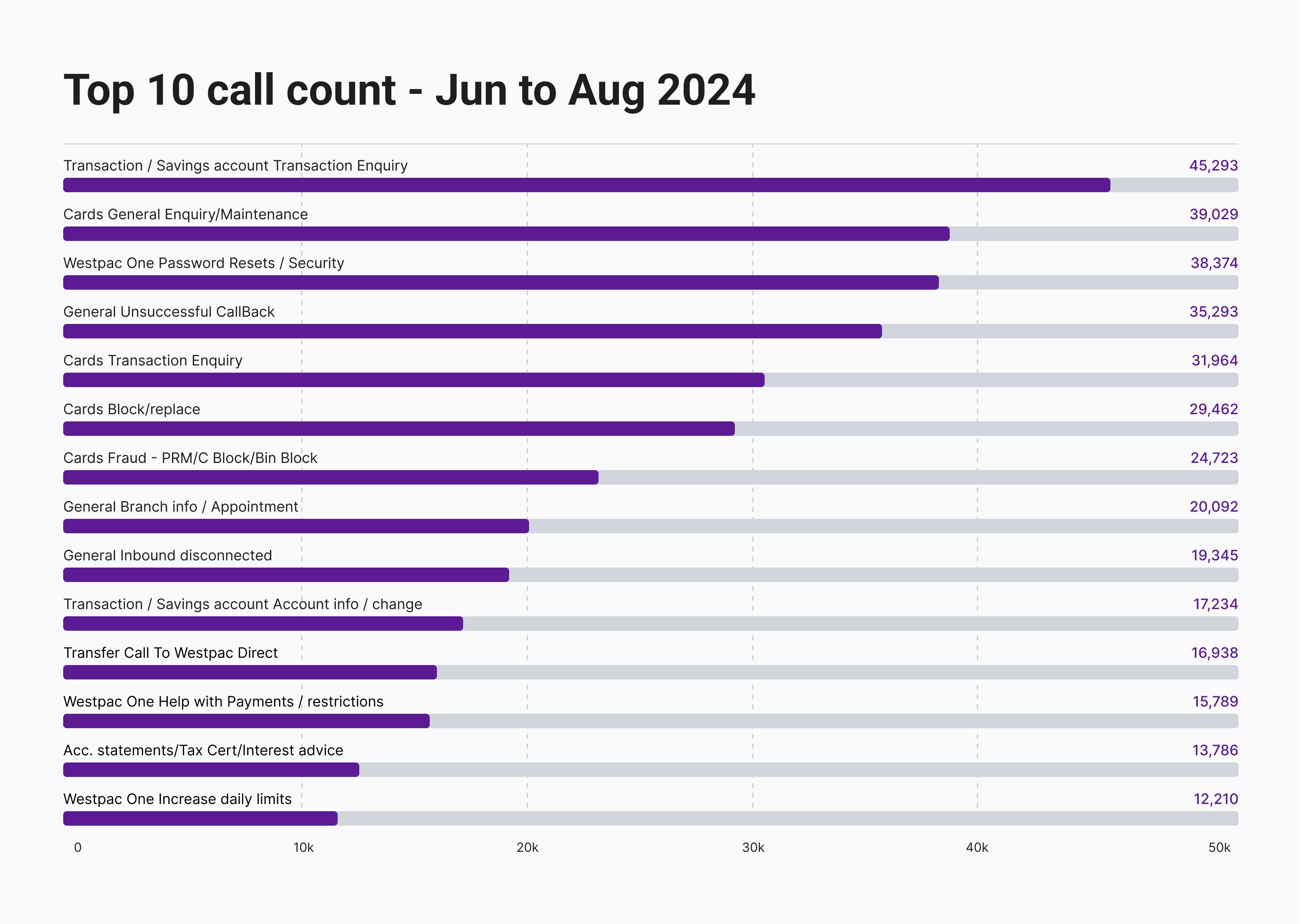

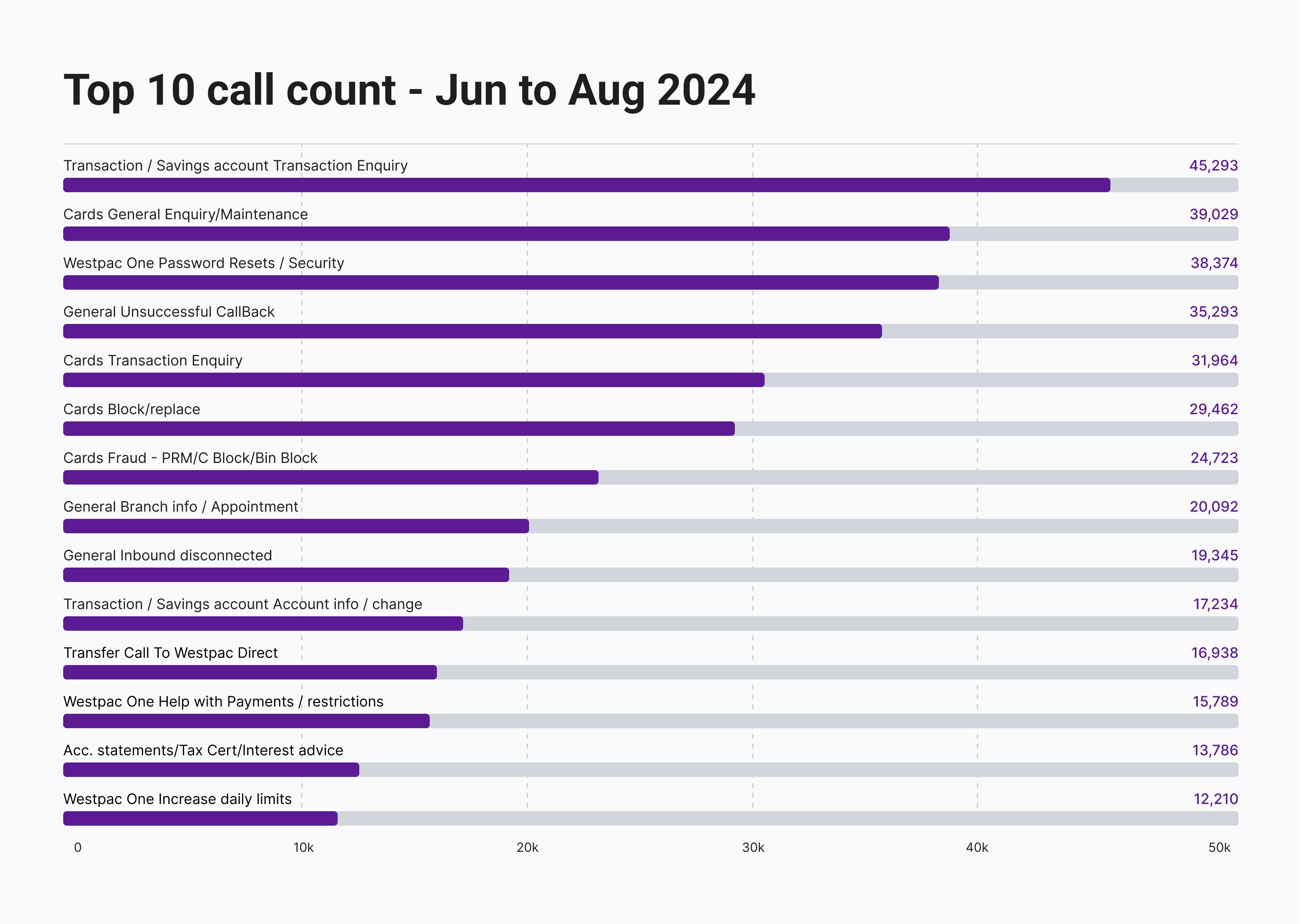

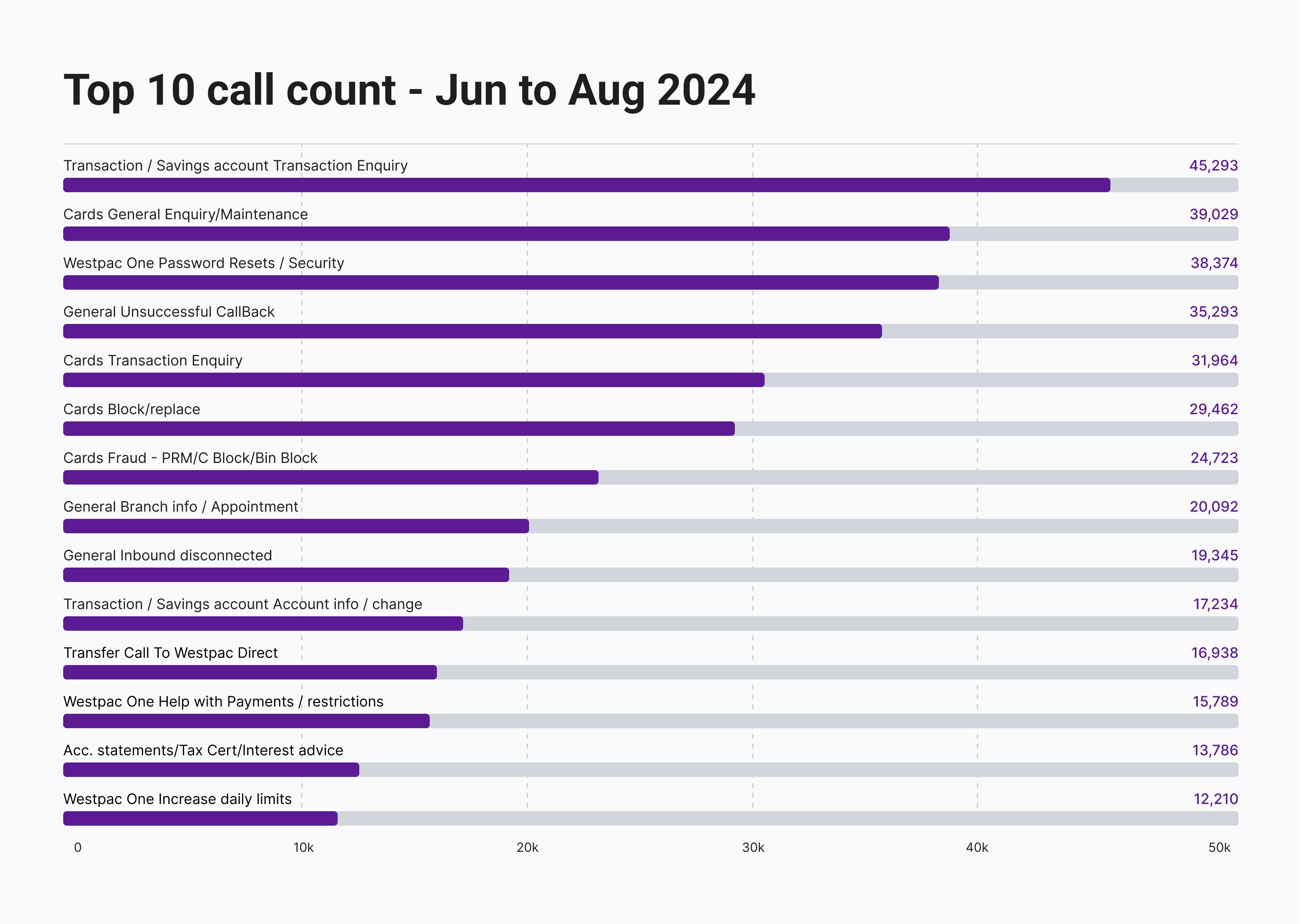

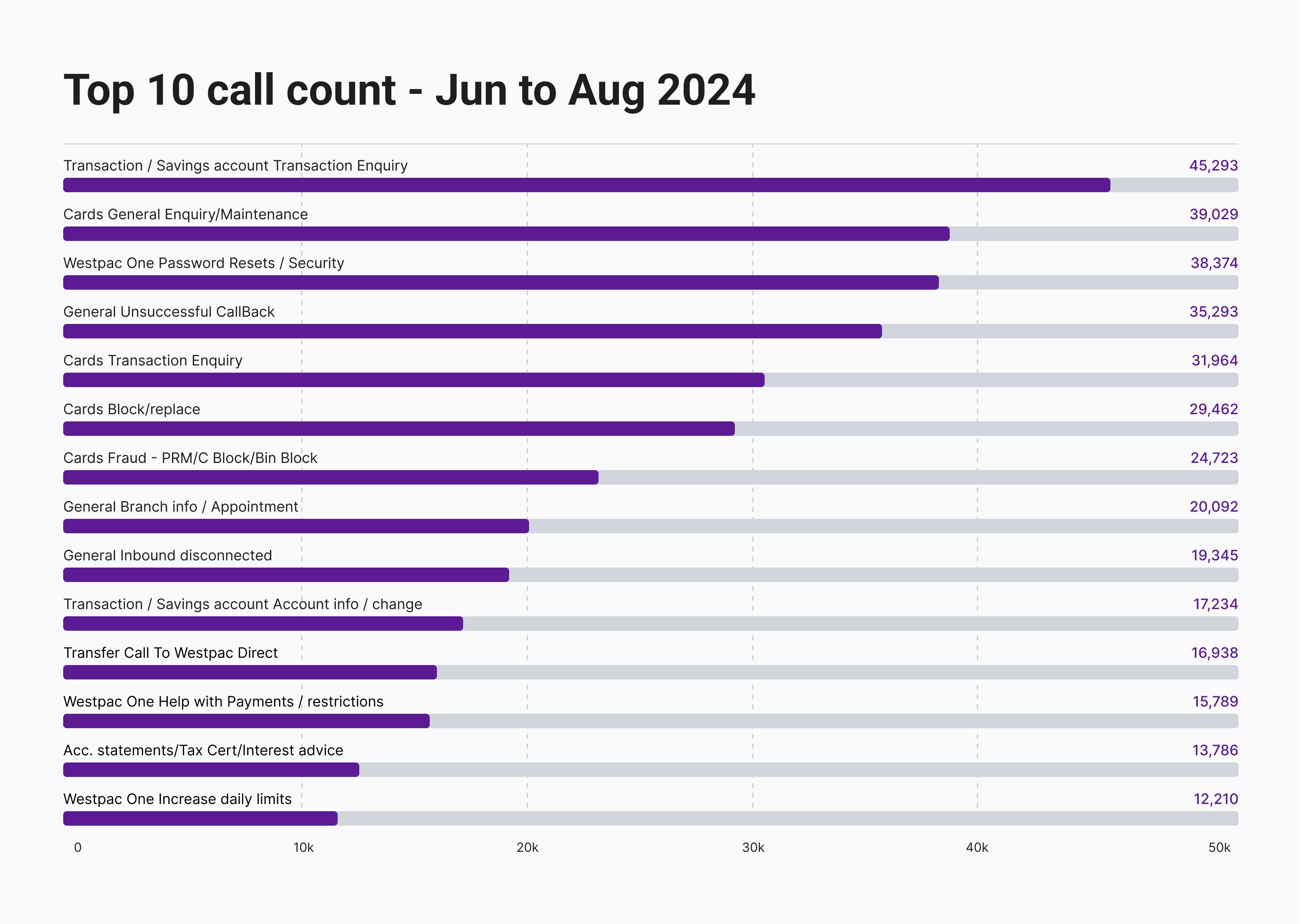

High call-centre volume for card-related enquiries

Increased branch visits and frontline staff workload

Opportunity

Native the Cards Hub to improve speed, visibility, and usability

Enable digital cards (Apple Pay / Google Pay) with enhanced security so customers can transact immediately and safely

Leadership & Strategy

Stakeholder Alignment & Discovery

End-to-End Design Leadership

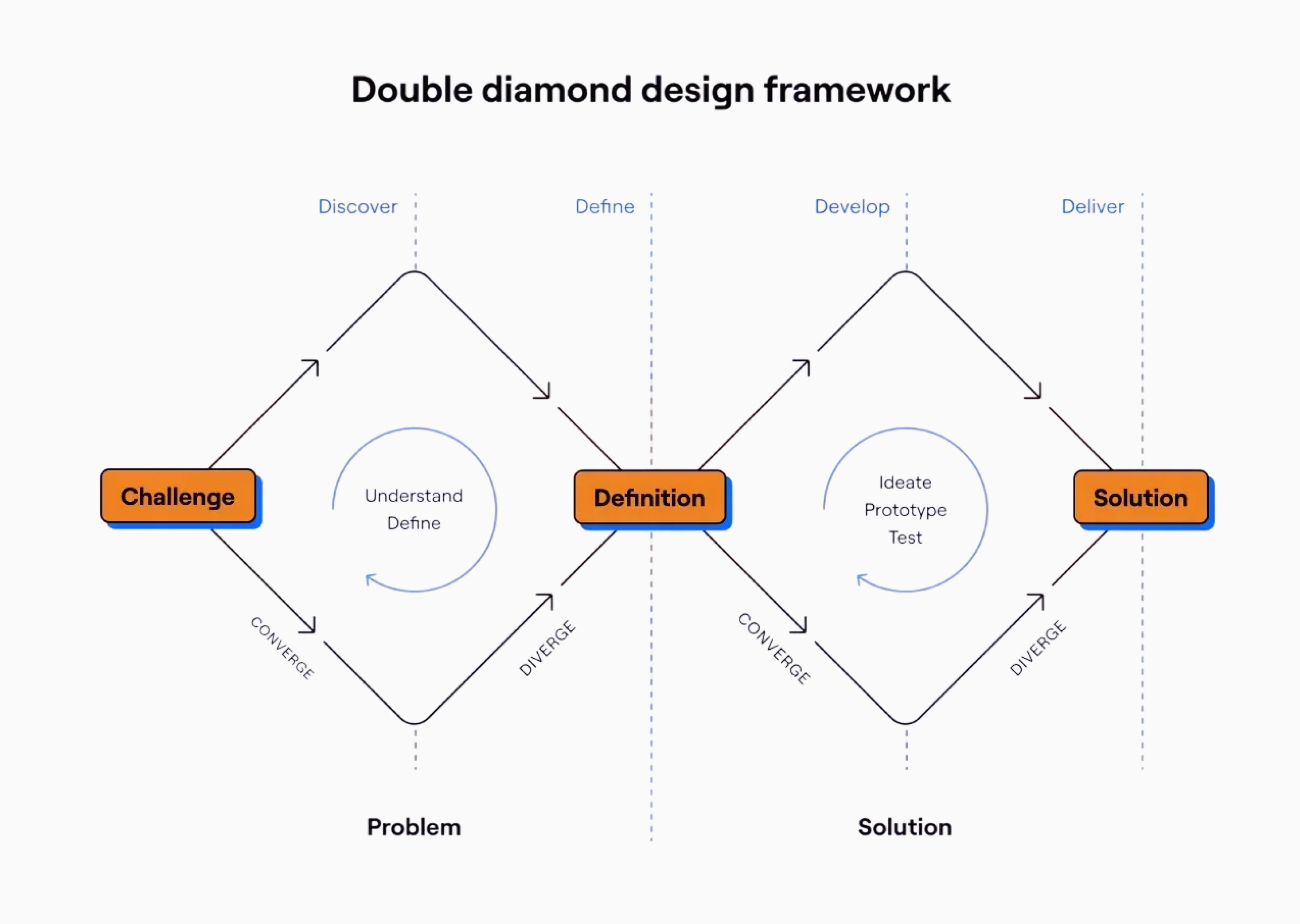

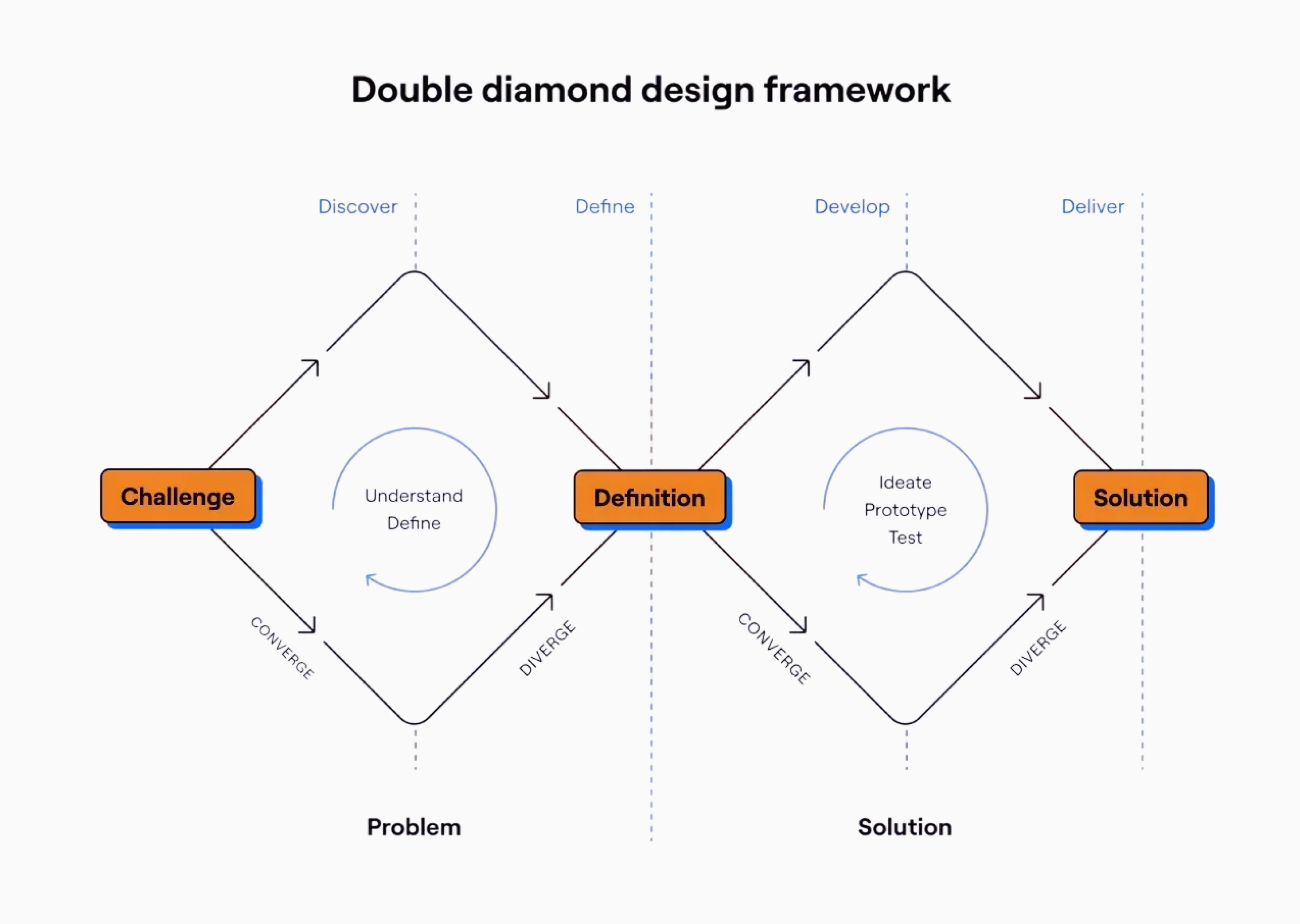

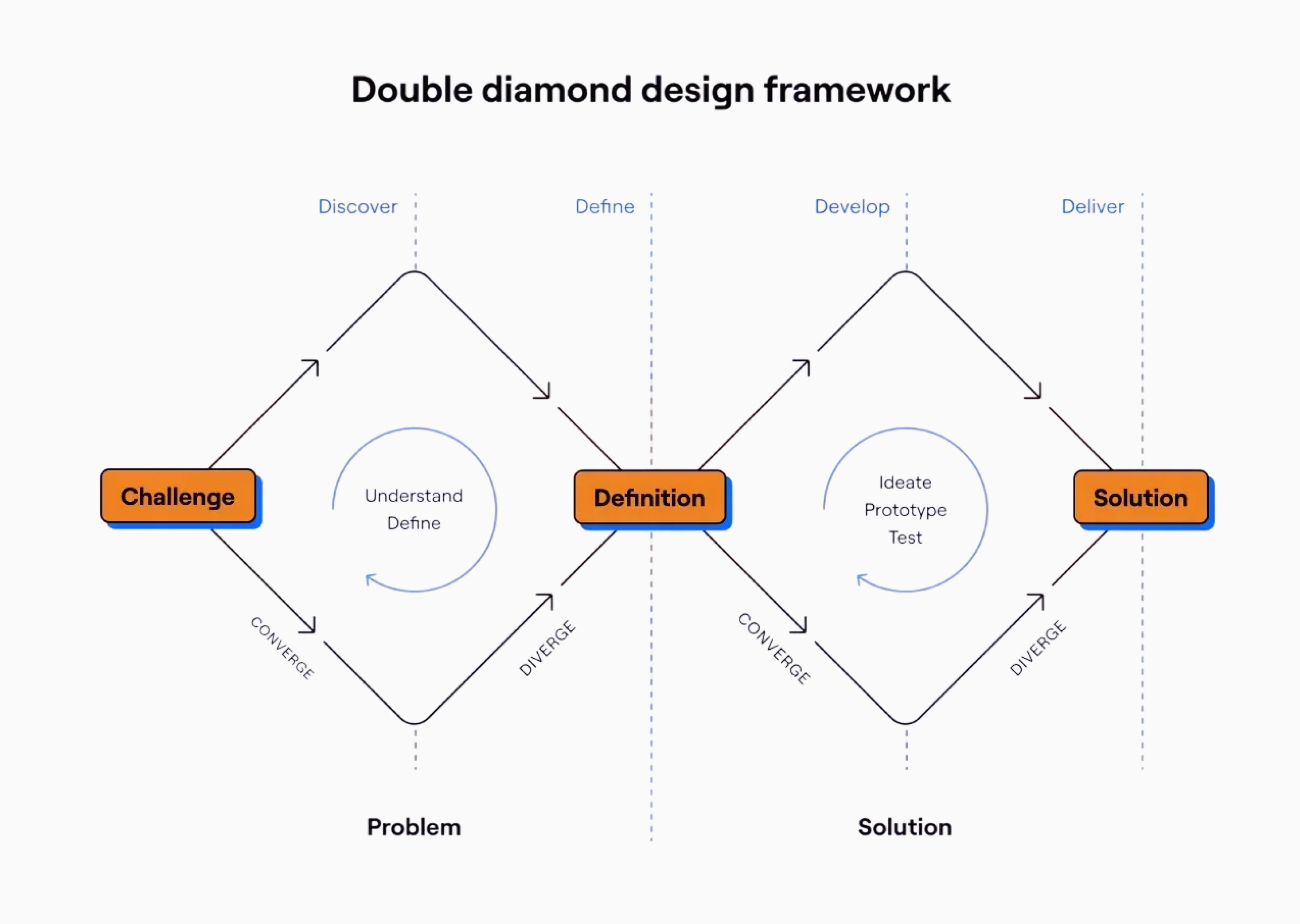

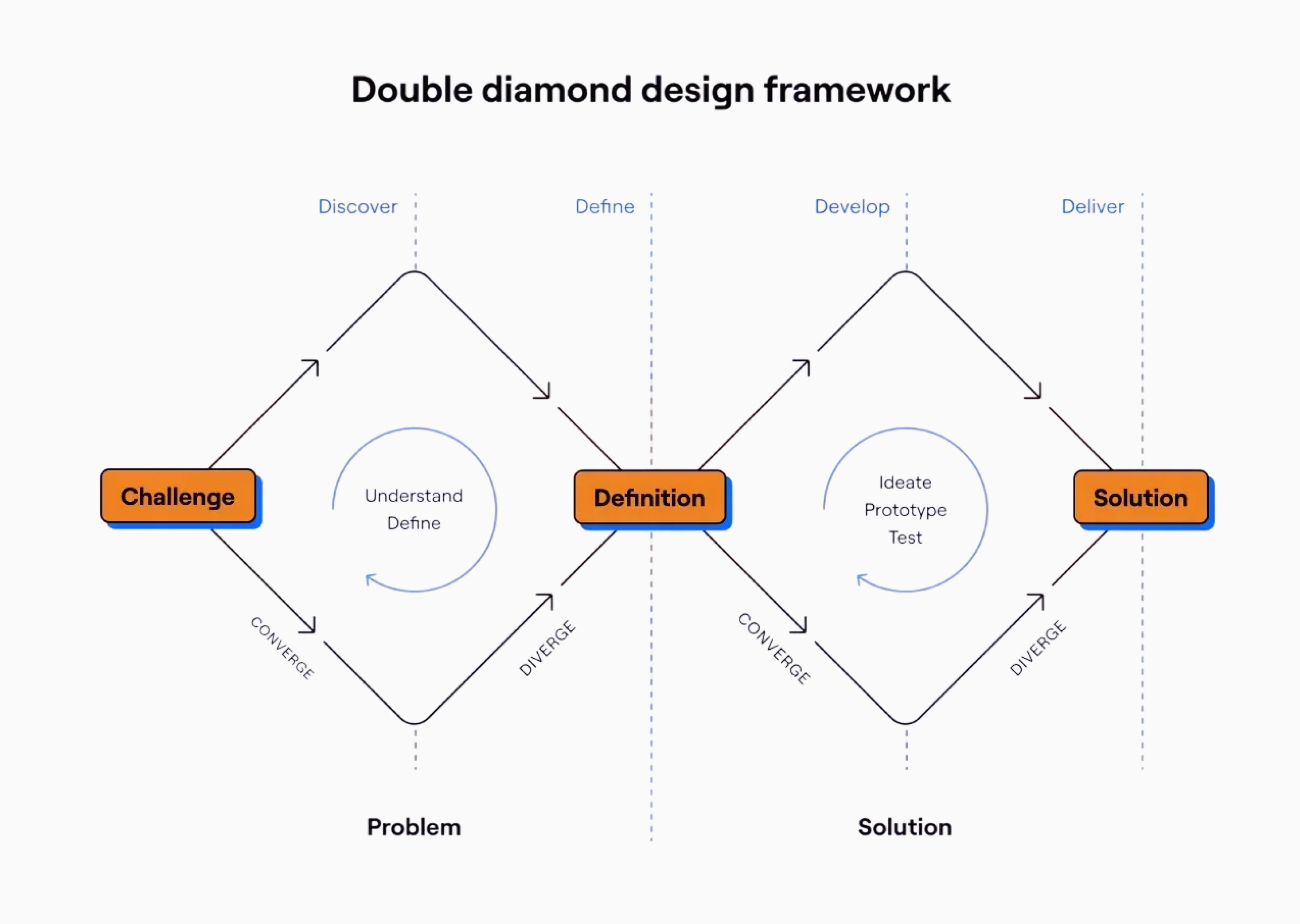

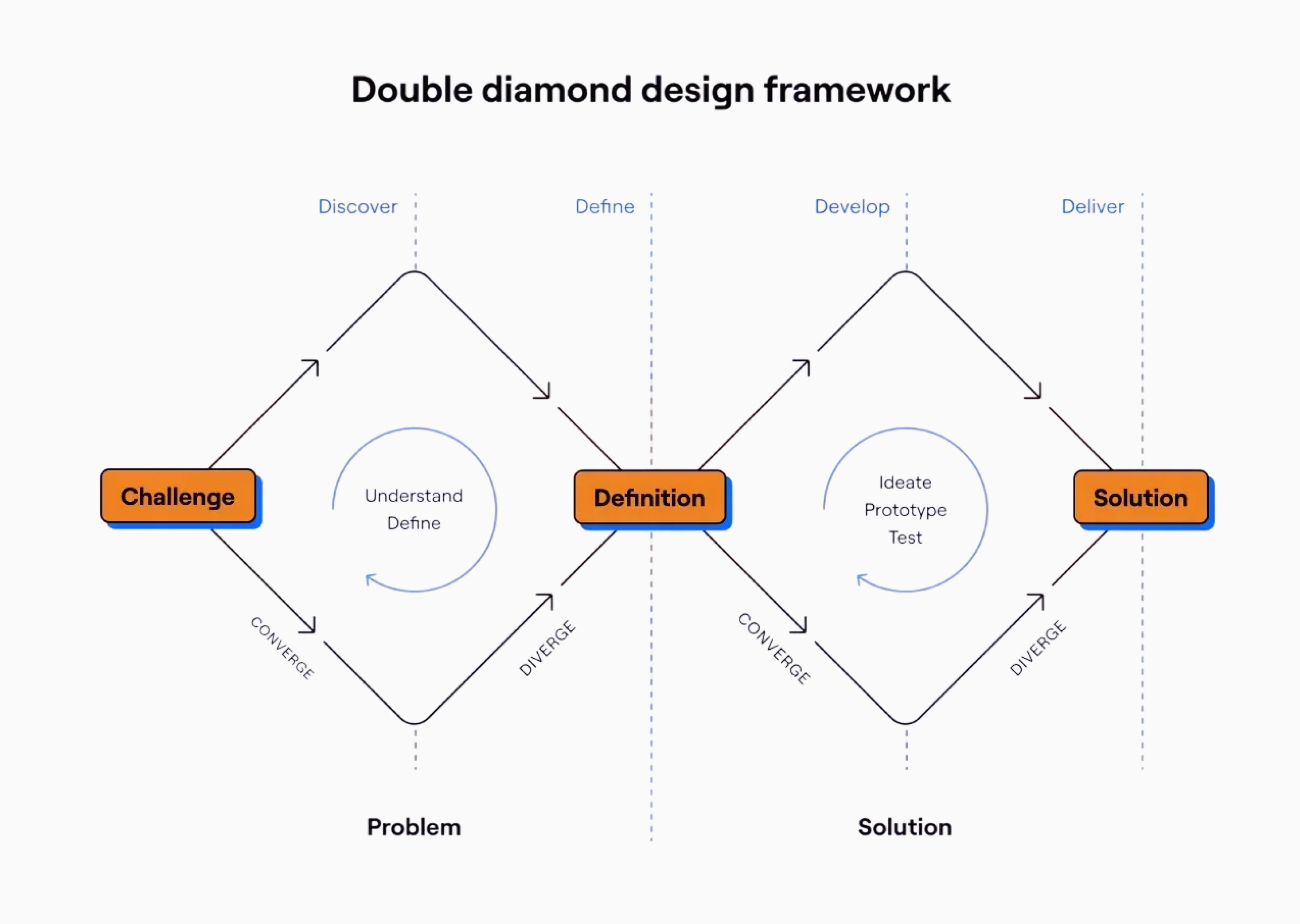

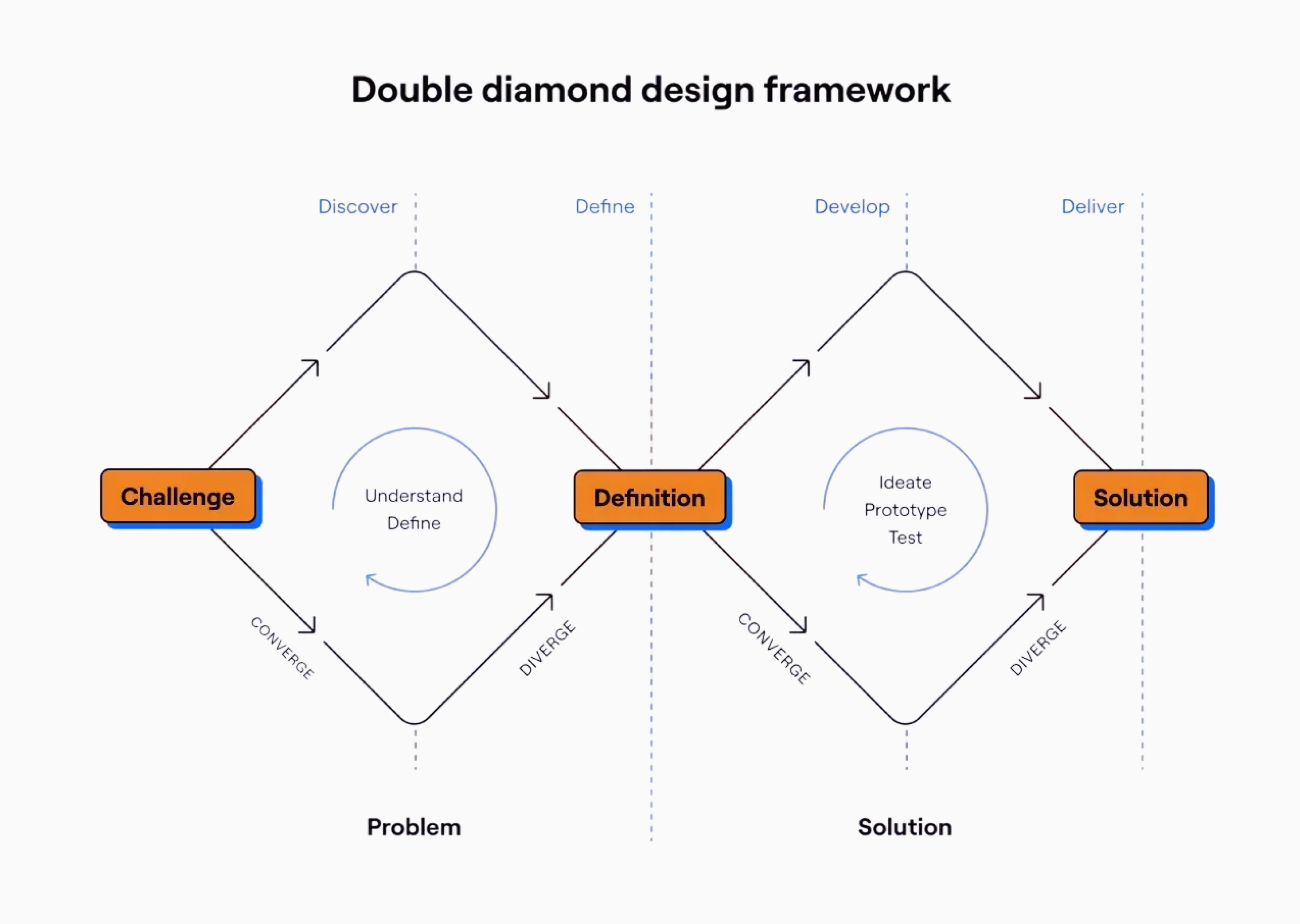

Owned the project across the Double Diamond: discovery → definition → delivery

Provided fortnightly updates to senior leadership to align on progress and trade-offs

Cross-Functional Collaboration

Partnered closely with:

Security & Architecture to validate authentication and fraud controls

Customer Support to ground decisions in real call drivers

Engineering to ensure designs were feasible within platform constraints

Design Practice & Team Enablement

Established weekly designer collaboration sessions to address mobile inconsistency

Encouraged shared critique and design-system contribution

Mentored junior designers with hands-on project ownership and feedback loops

User-Centred Research

I combined quantitative analysis of top call drivers with qualitative insights from customer calls and frontline staff to identify cards as a high-impact support issue, then validated solutions through competitor analysis of leading financial products (e.g., Revolut, Monzo, Wise), uncovering proven patterns such as card-first navigation, instant digital access, and clear, secure card details.

Iterative Prototyping & Testing

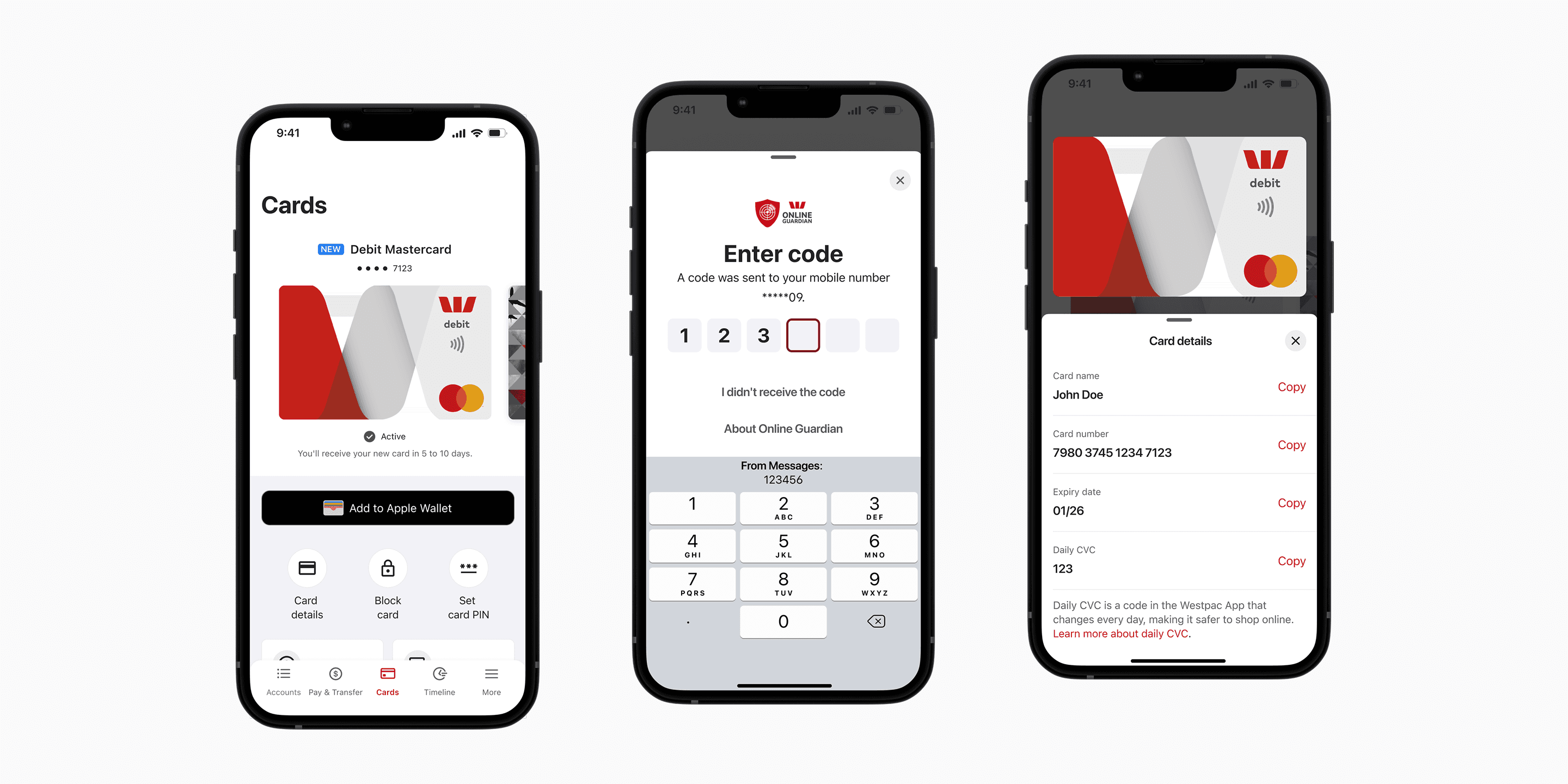

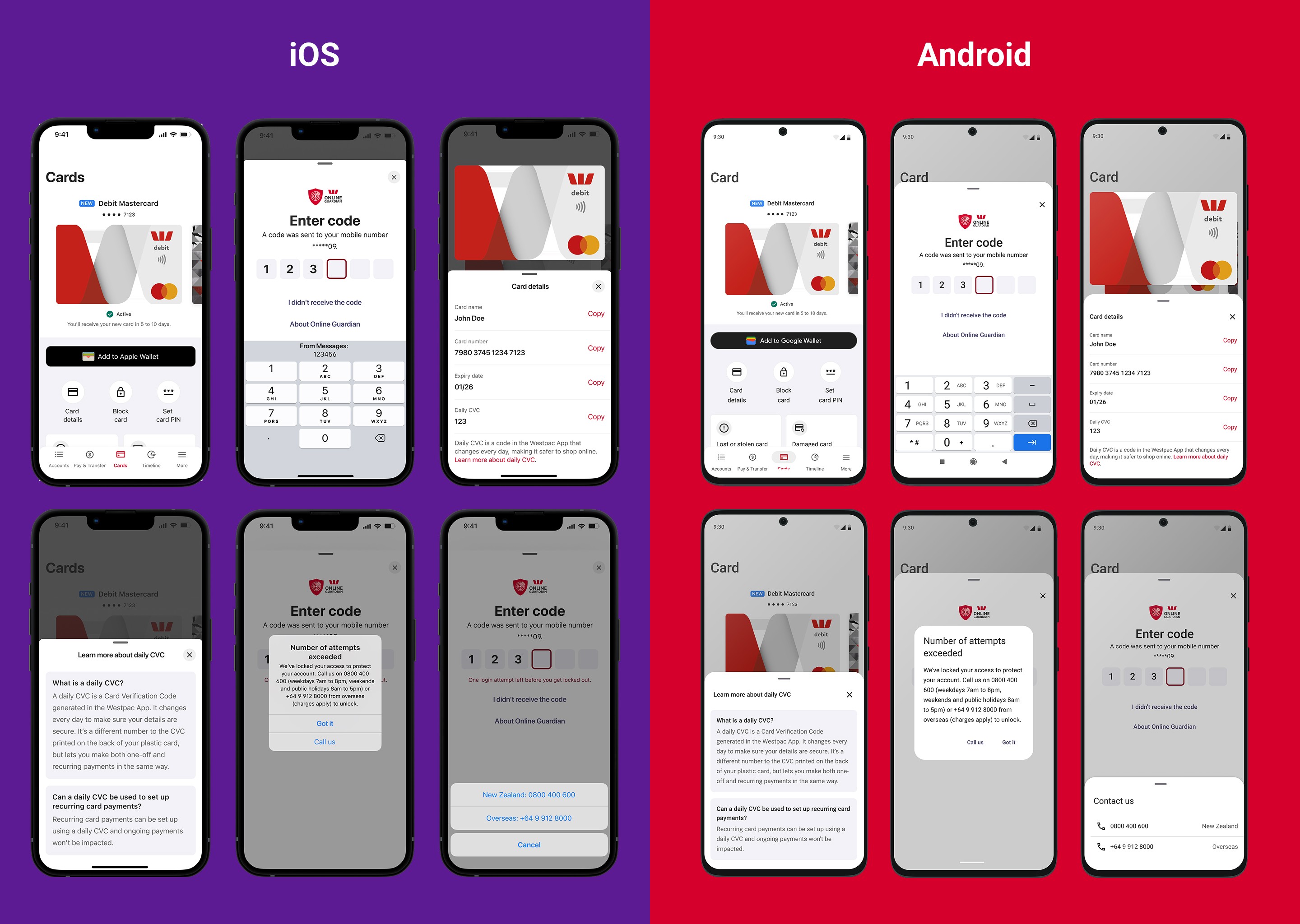

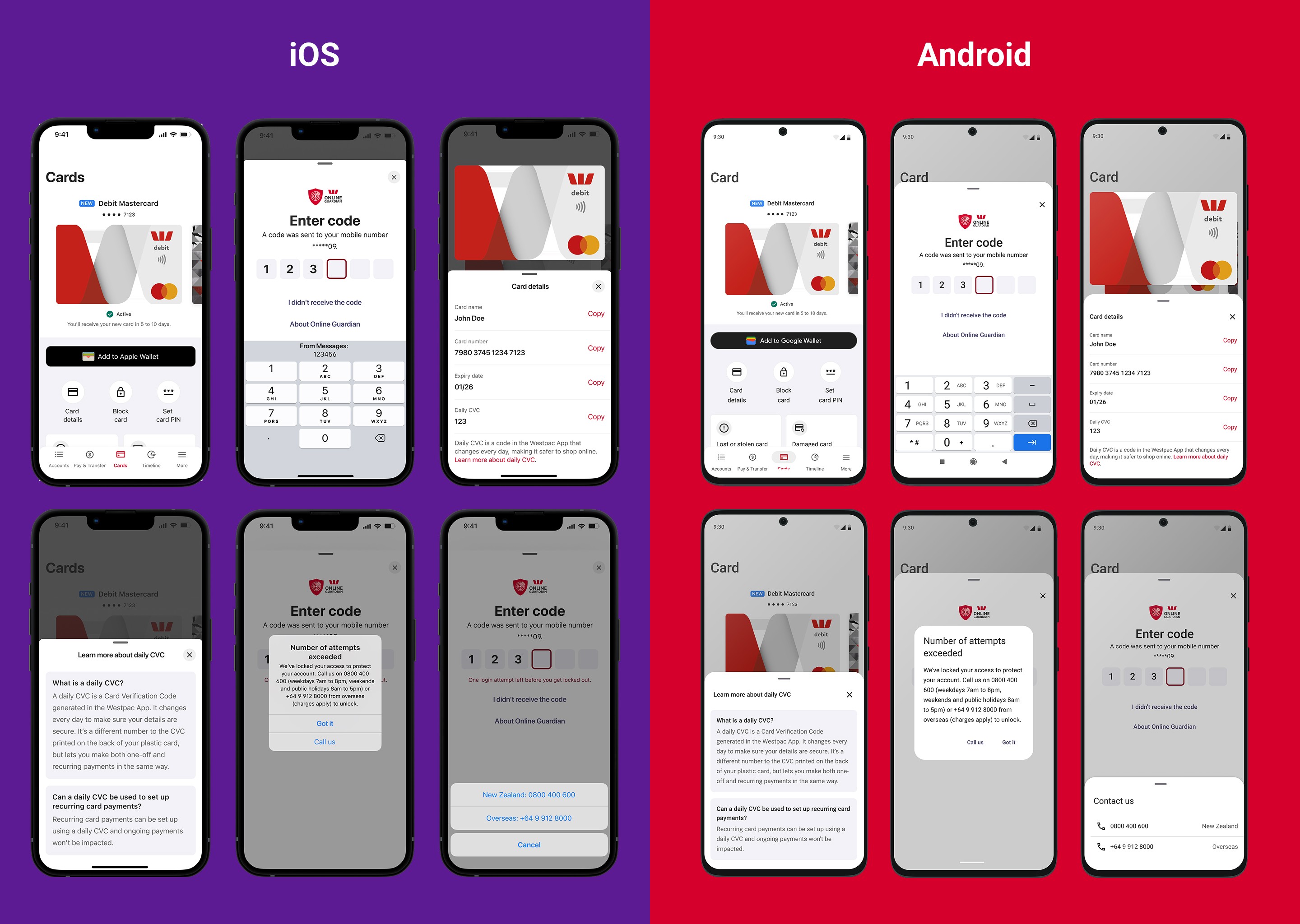

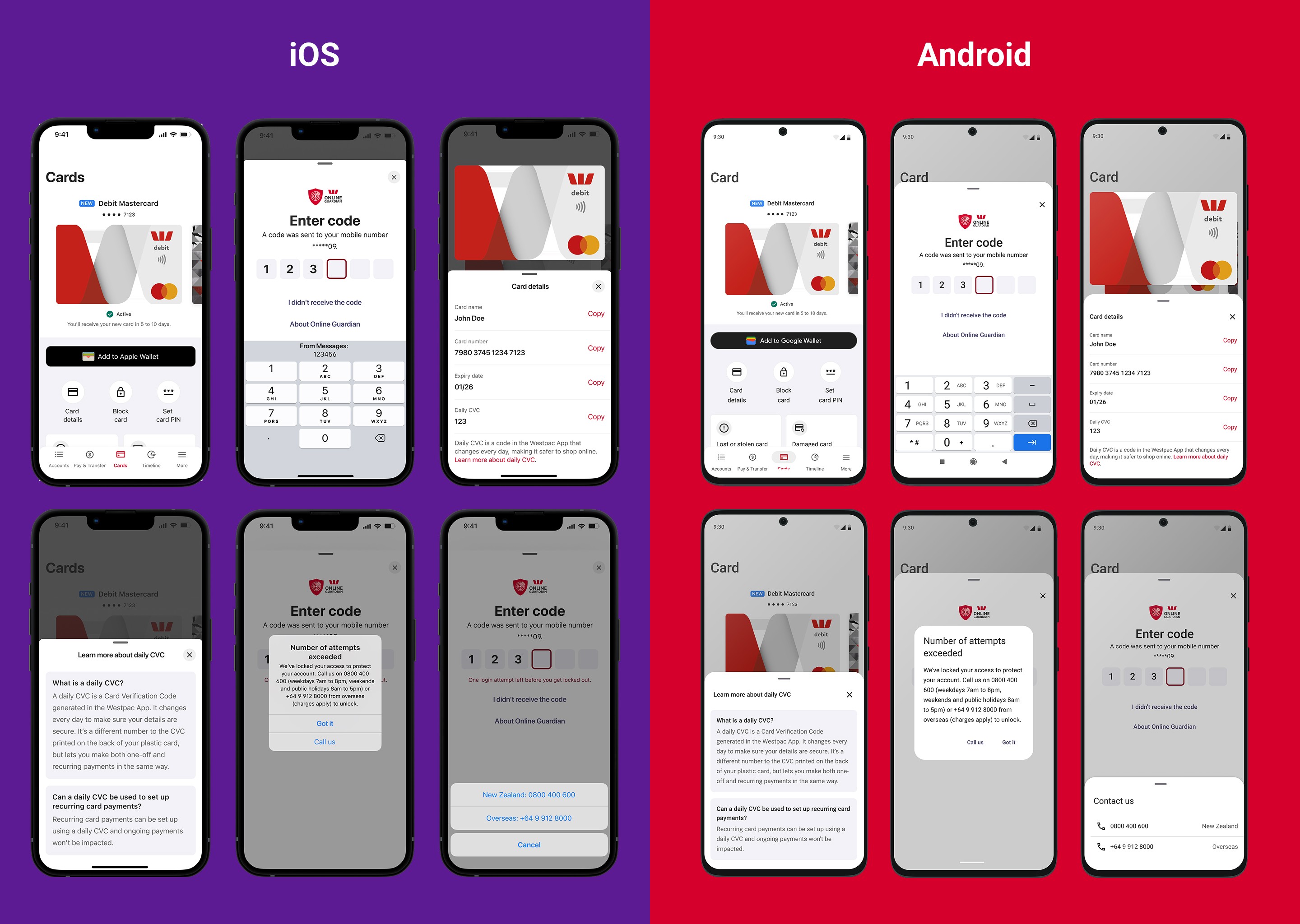

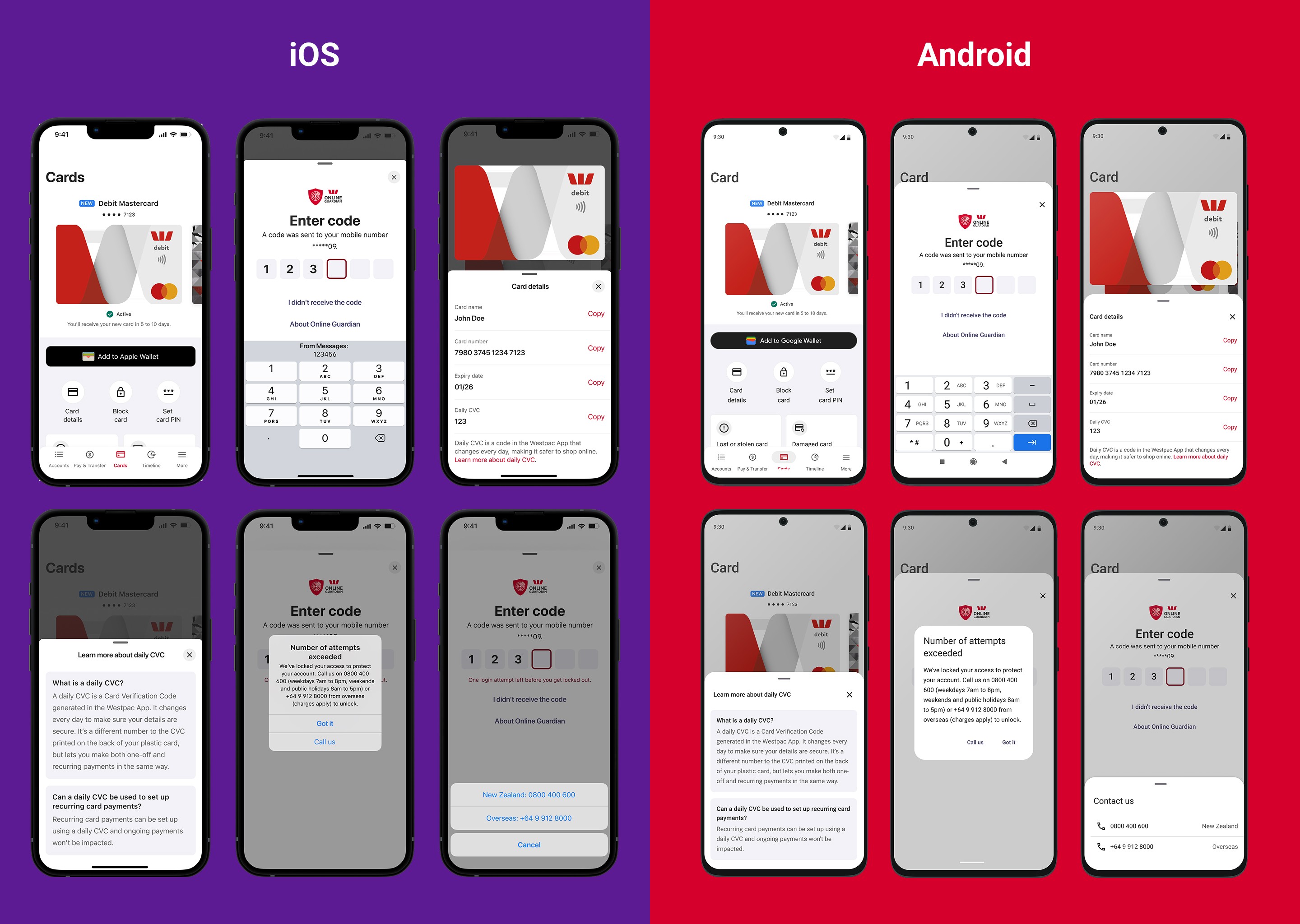

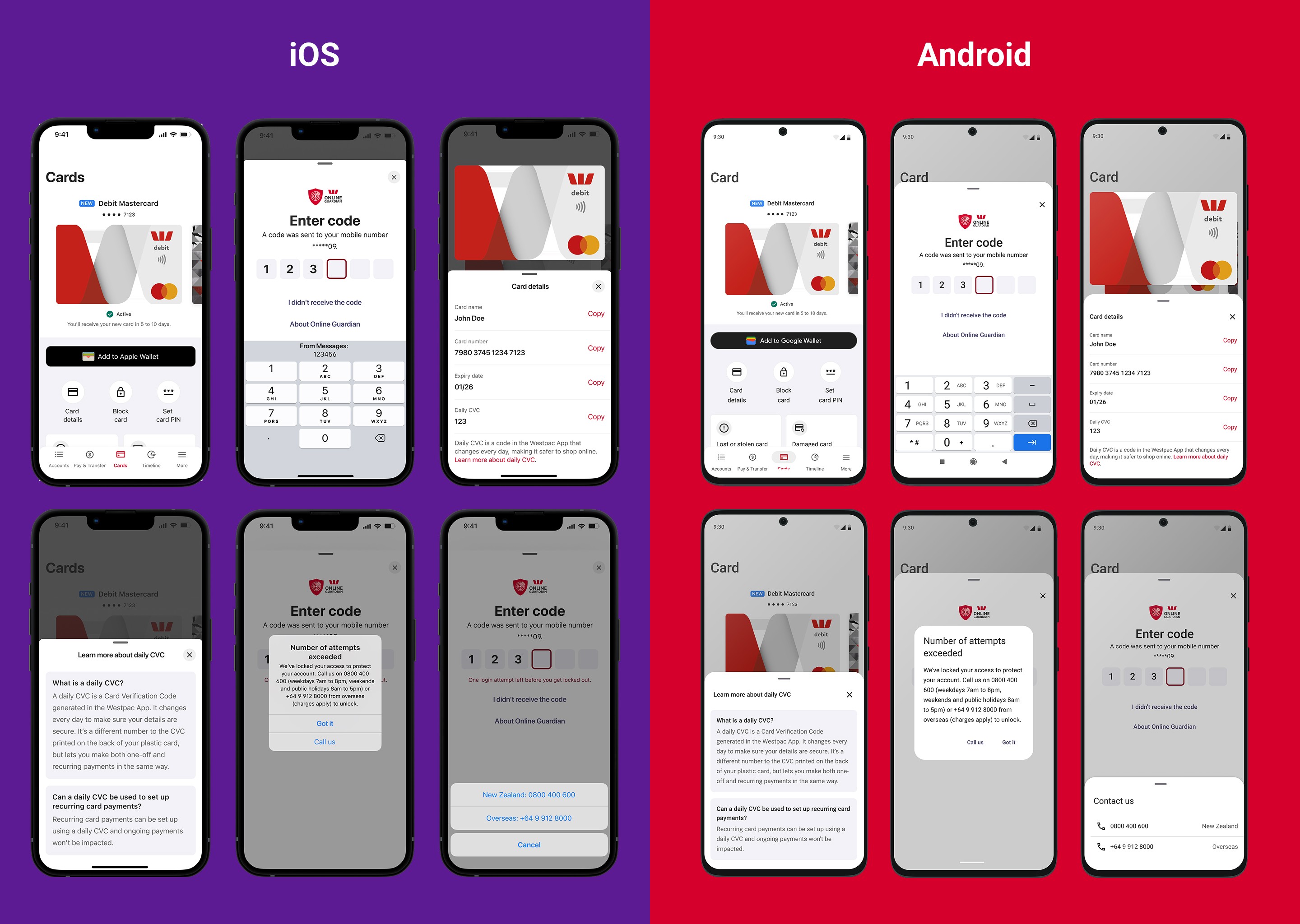

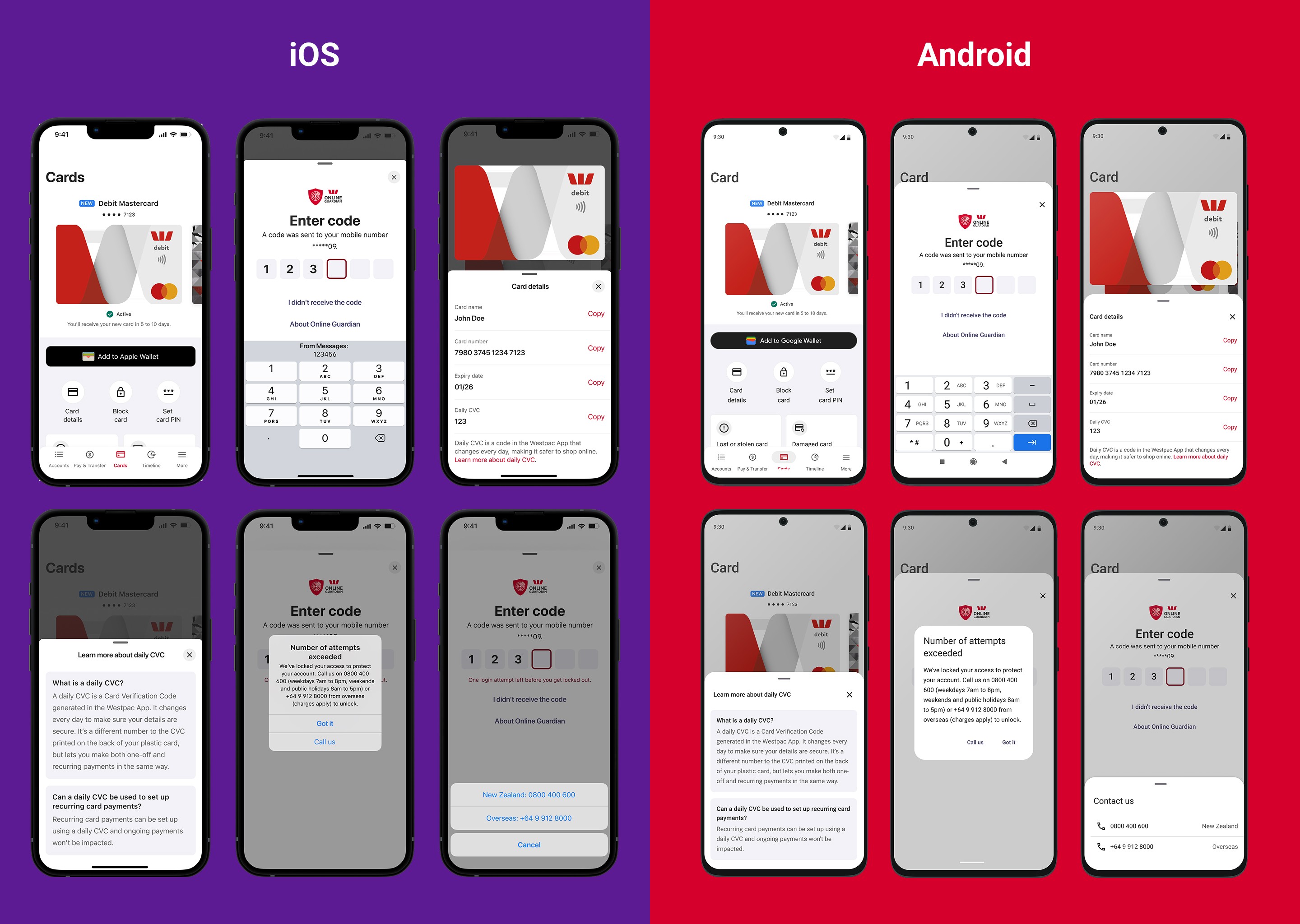

Cards Hub Redesign

Reduced card access from 3+ taps to a single, direct entry point

Reframed the Cards Hub as a control centre, inspired by iOS Control Center and Android Device Controls

Prioritised speed, clarity, and one-handed use

Digital Instant Issuance

Enabled customers to:

Add cards to Apple Pay / Google Pay immediately

Shop online safely before physical card arrival

Security-Driven Iteration

Ideal concept: Face ID–only access to card details

Constraint: Security team required stronger safeguards

Final solution:

Secure 6-digit in-app authentication

Daily rotating CVC (unique in NZ market), increasing fraud protection and customer confidence

Design System Contribution

Developed new UI components and standards in the RED design system to maintain consistency and scalable design practice.

Key UX Solutions

Enhancements Included

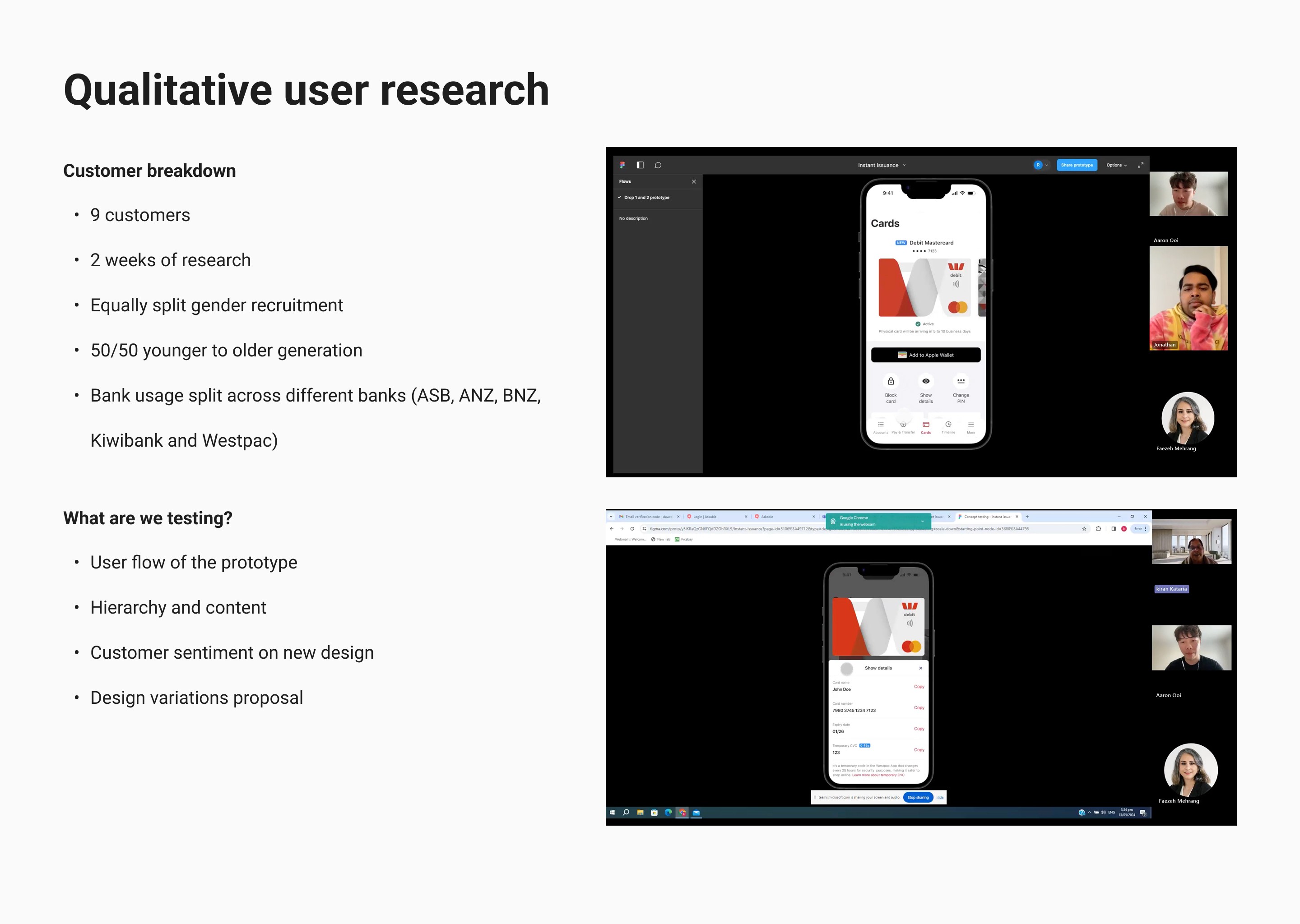

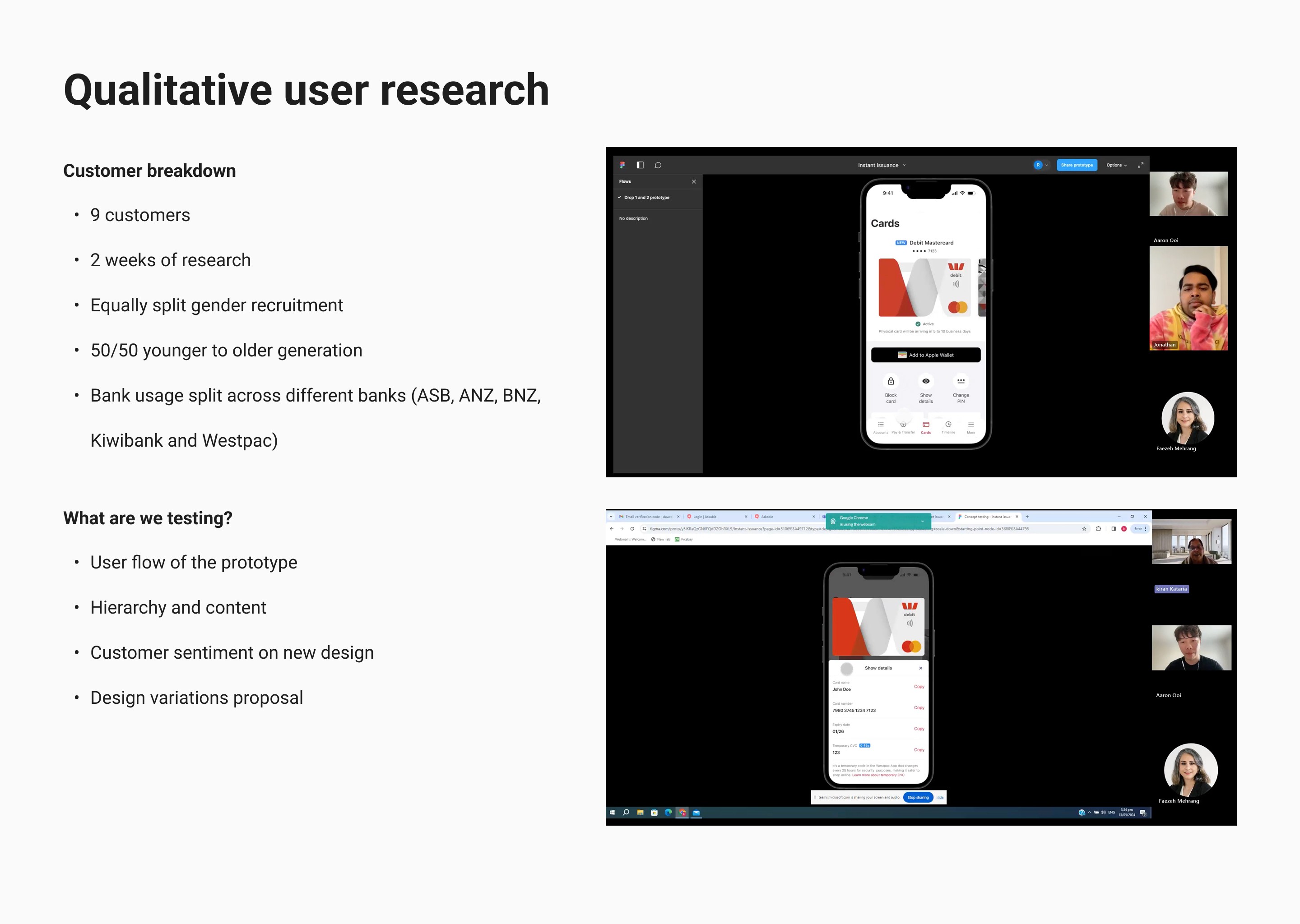

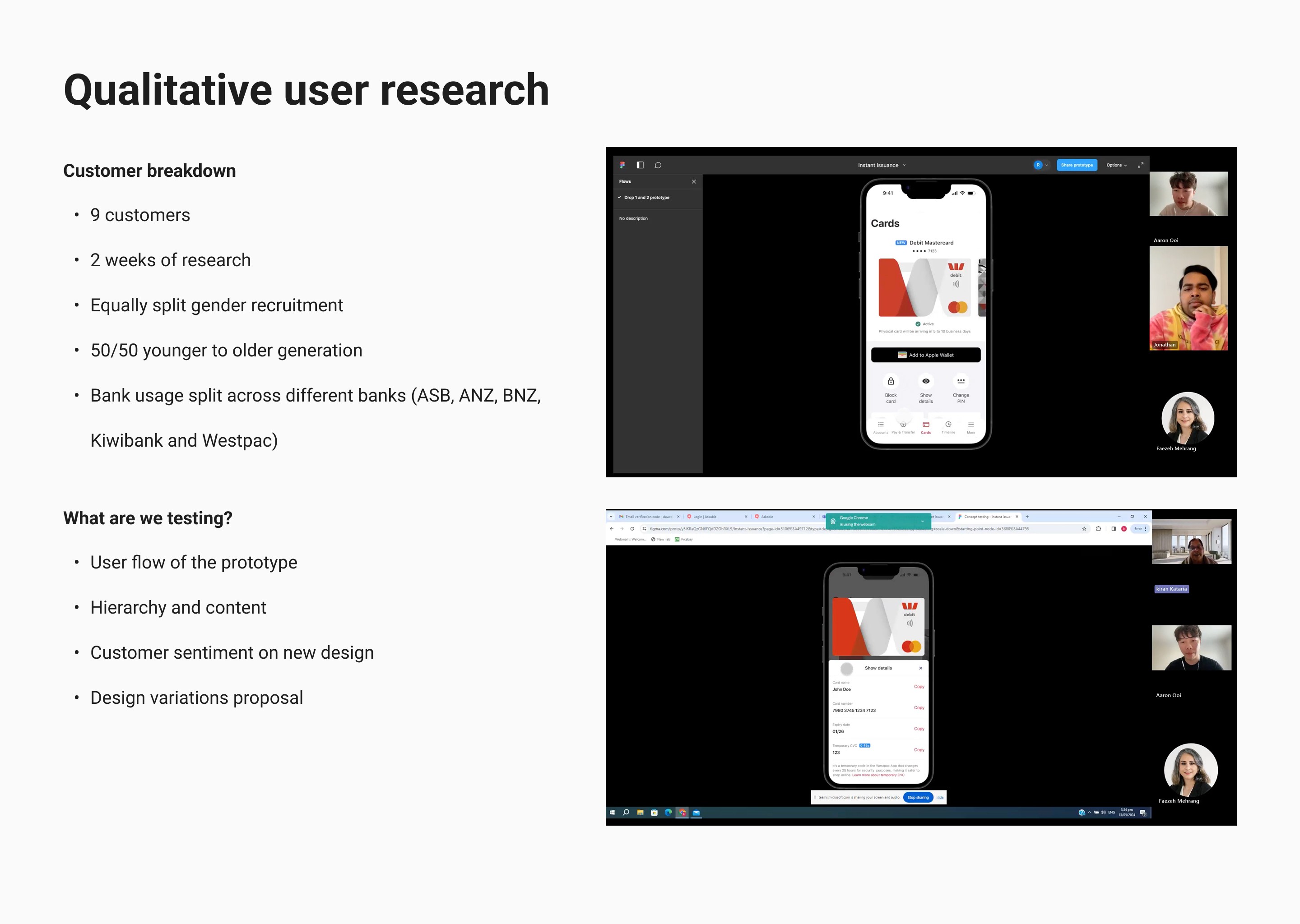

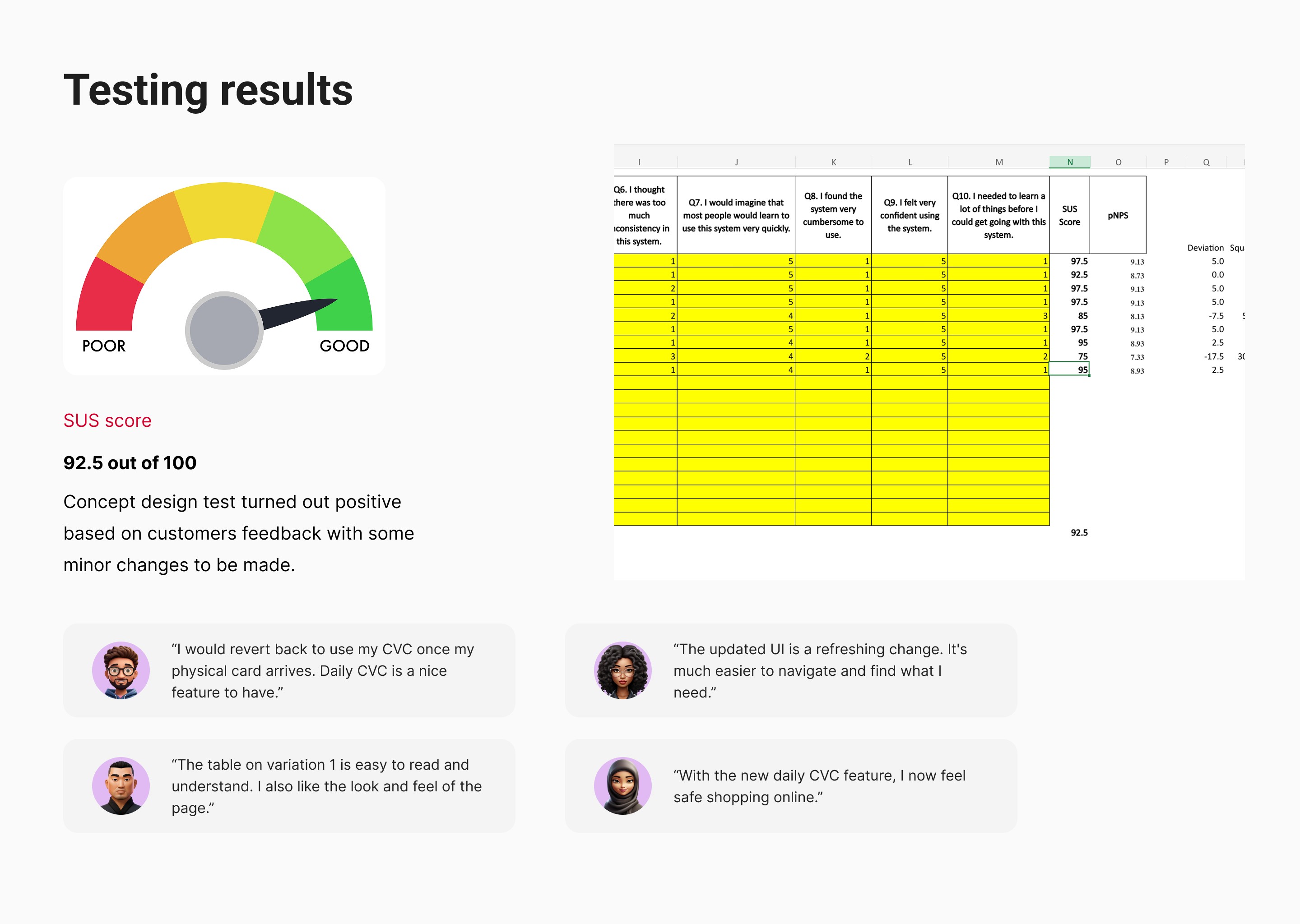

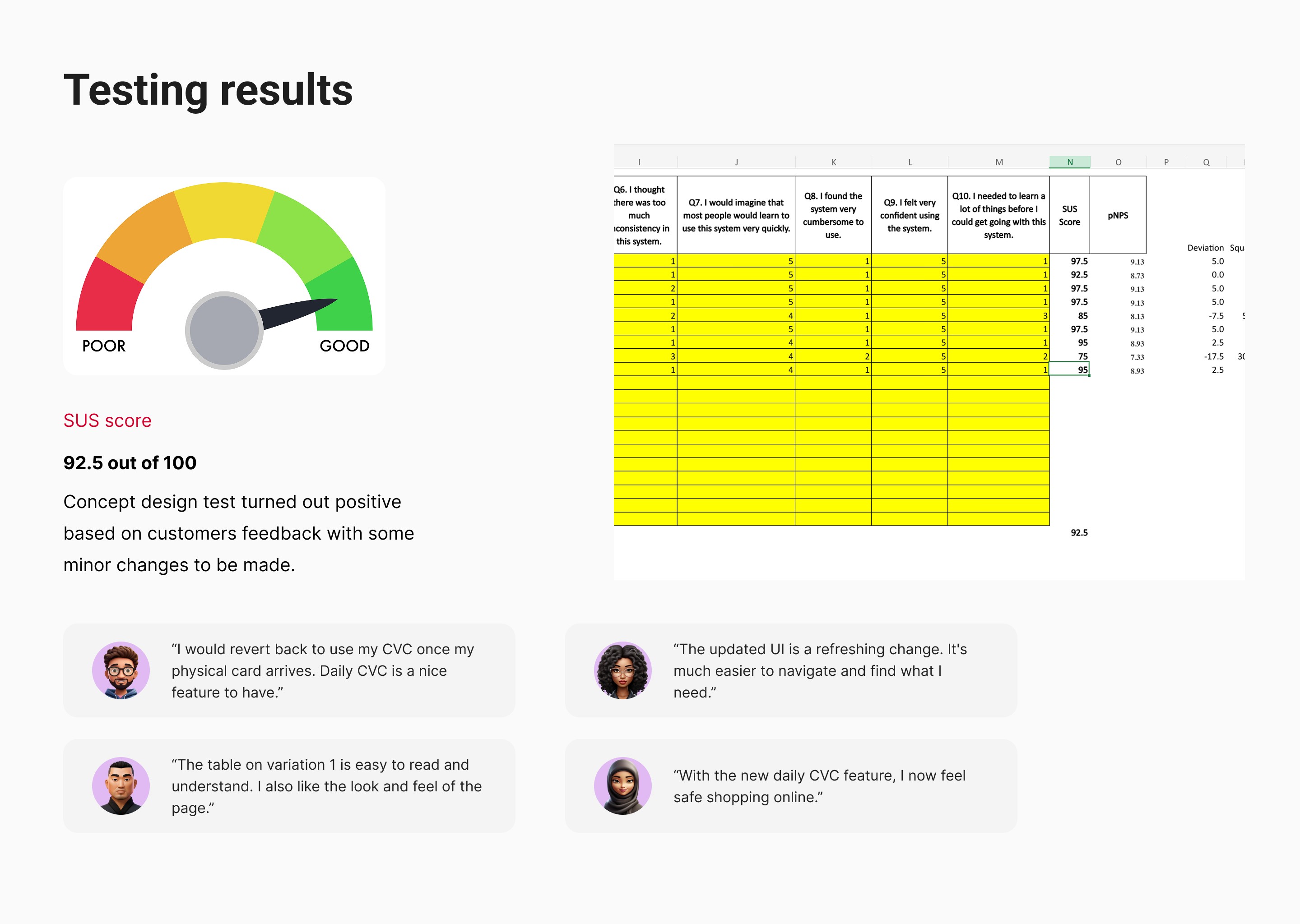

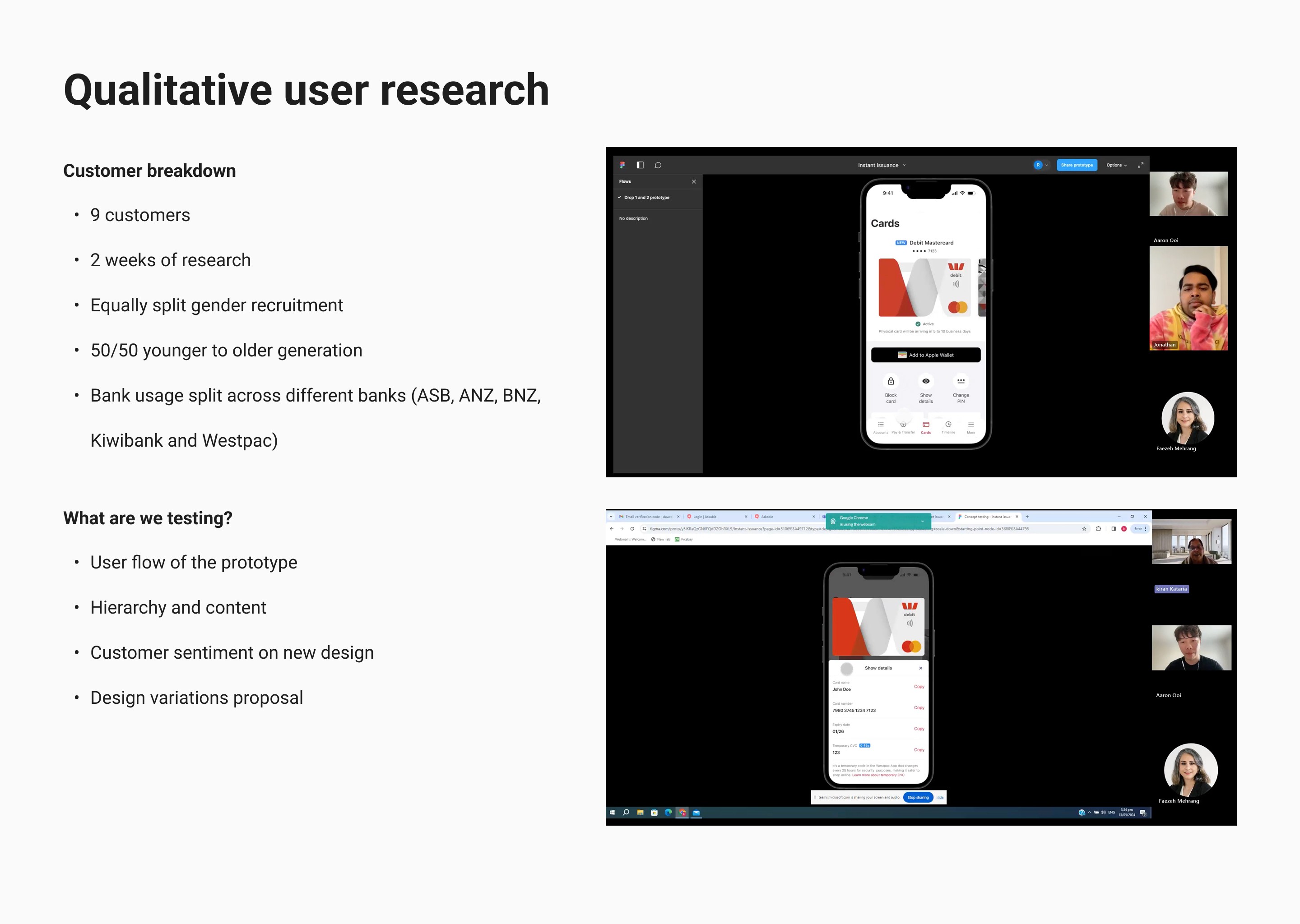

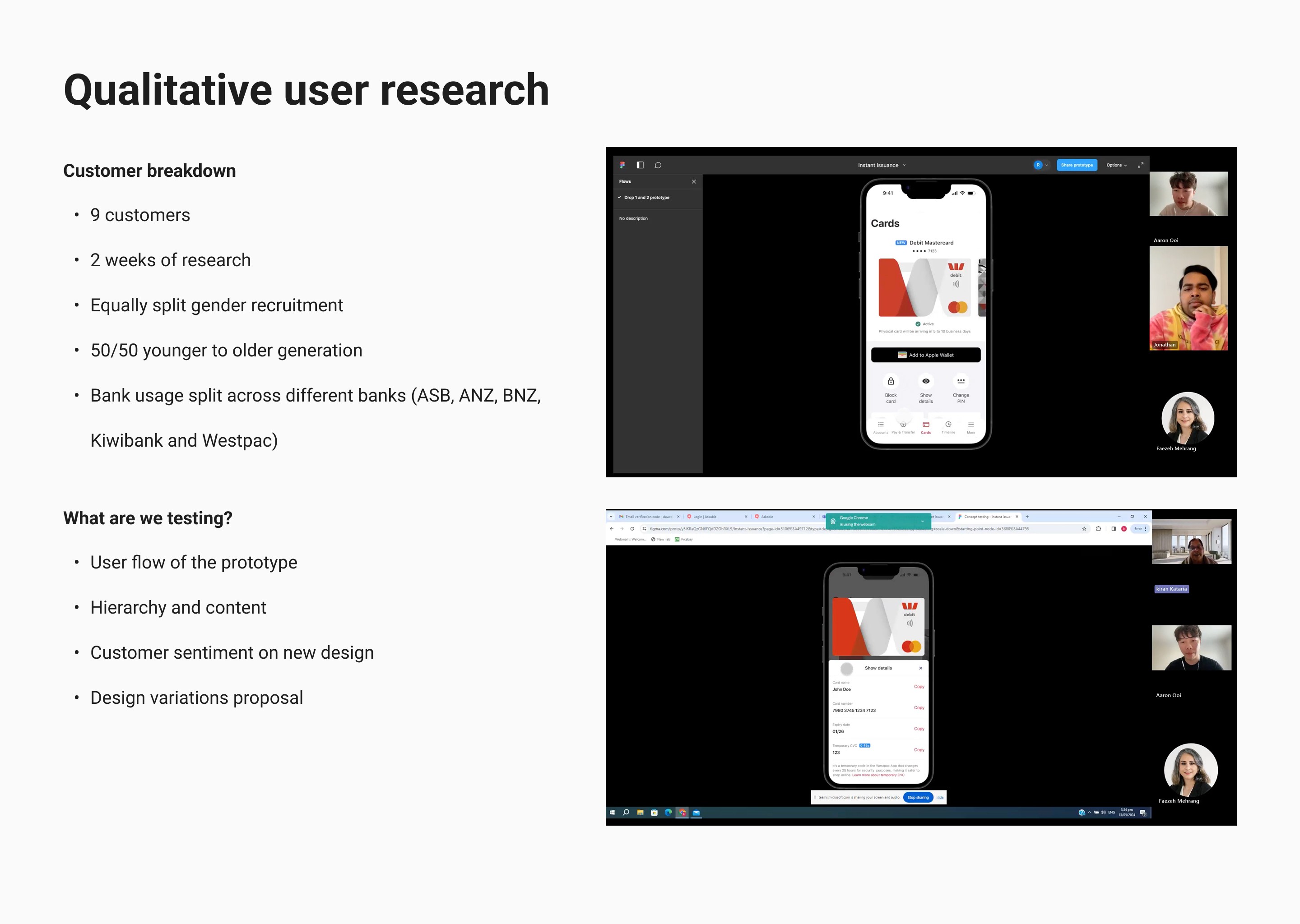

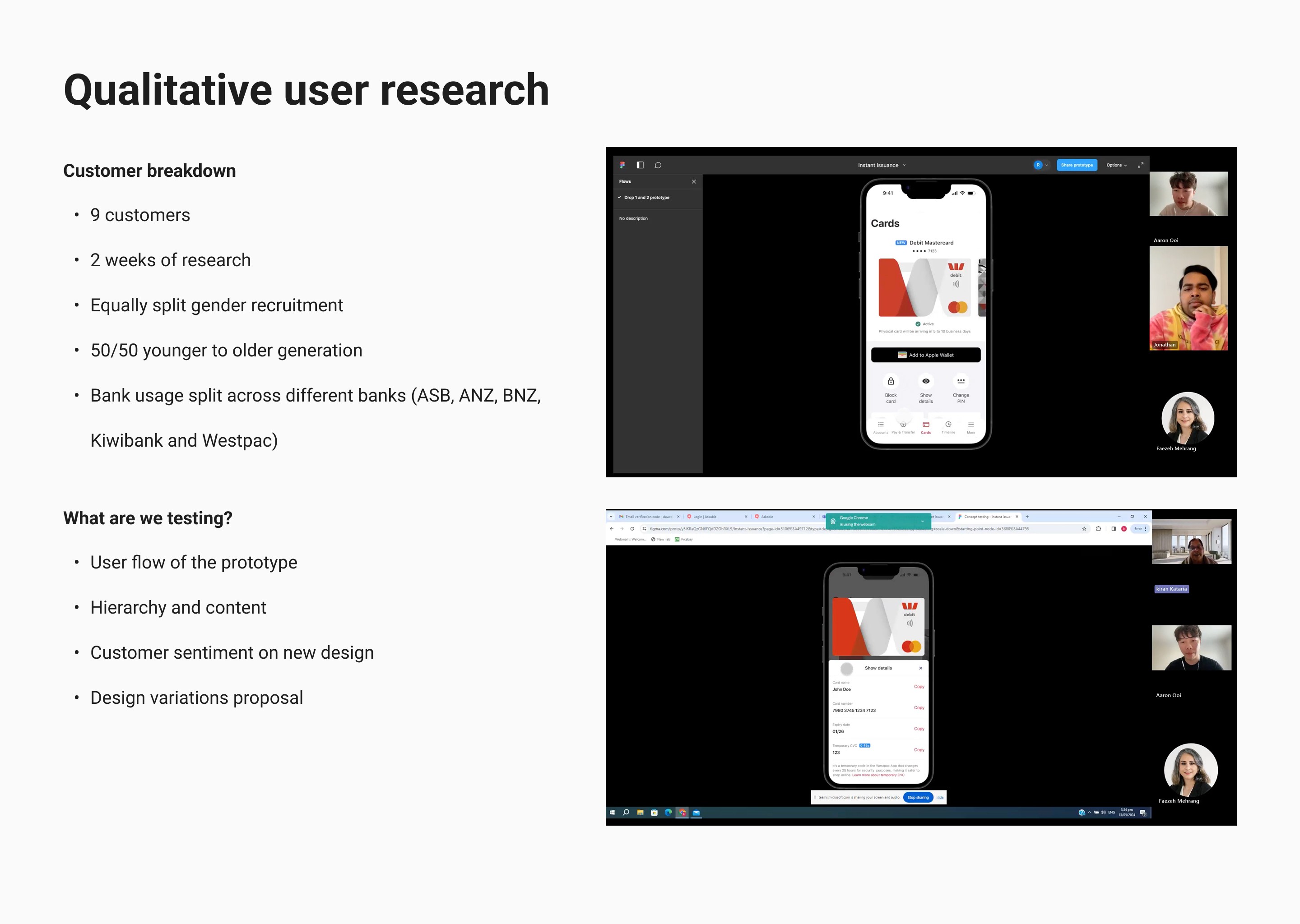

Research Setup

9 customers over 2 weeks

Balanced gender split, mixed age groups

Users from multiple NZ banks (ASB, ANZ, BNZ, Kiwibank, Westpac)

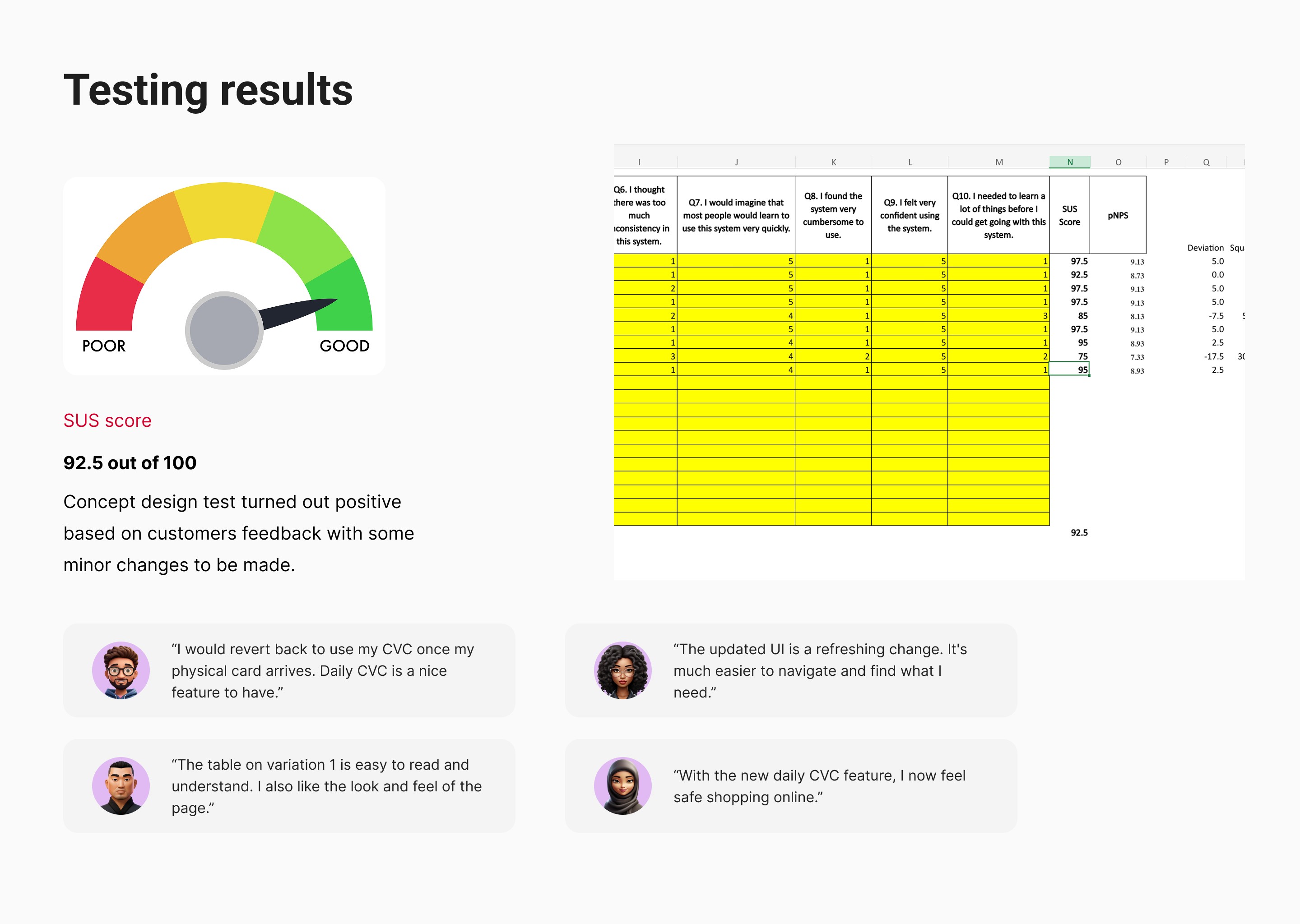

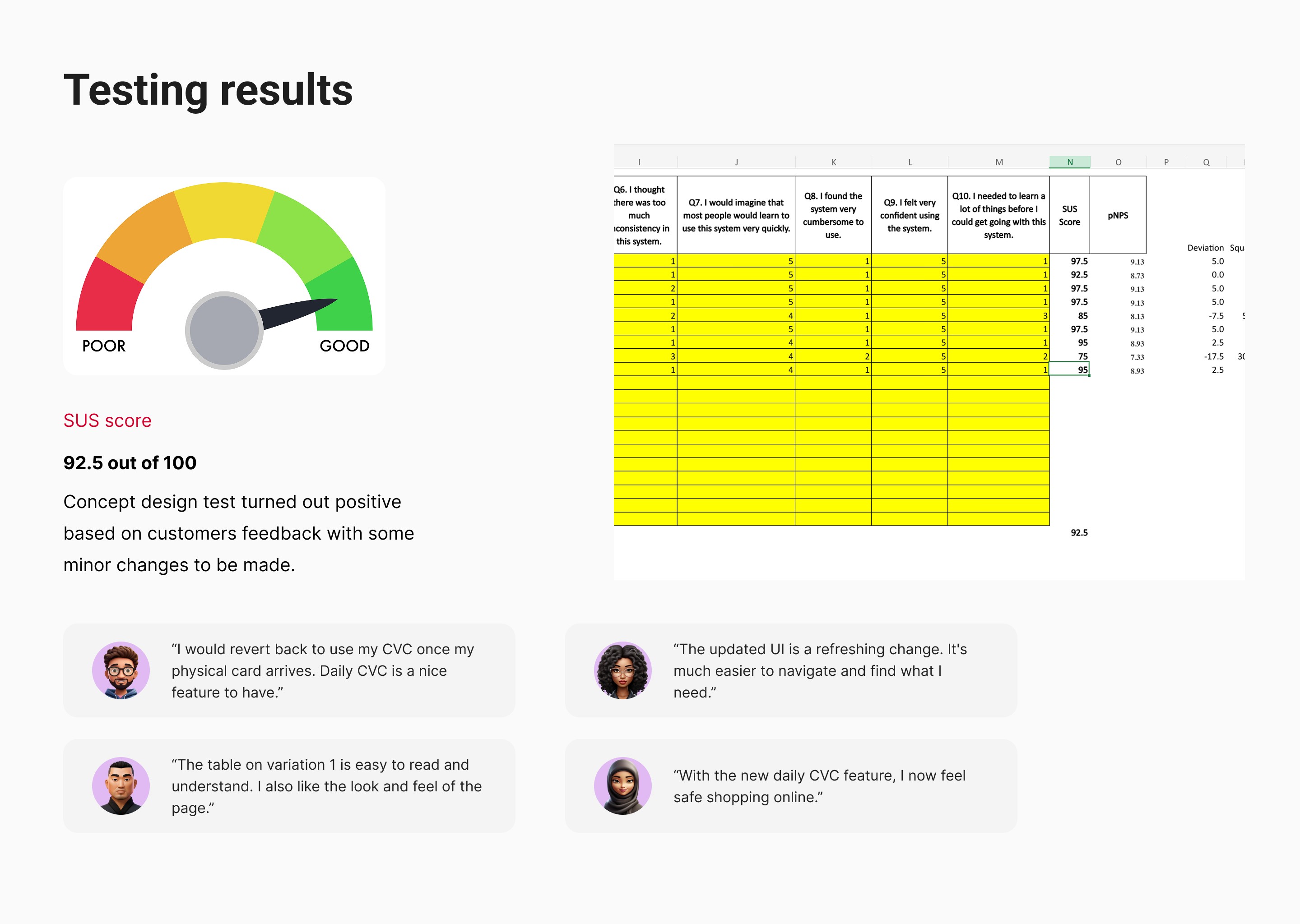

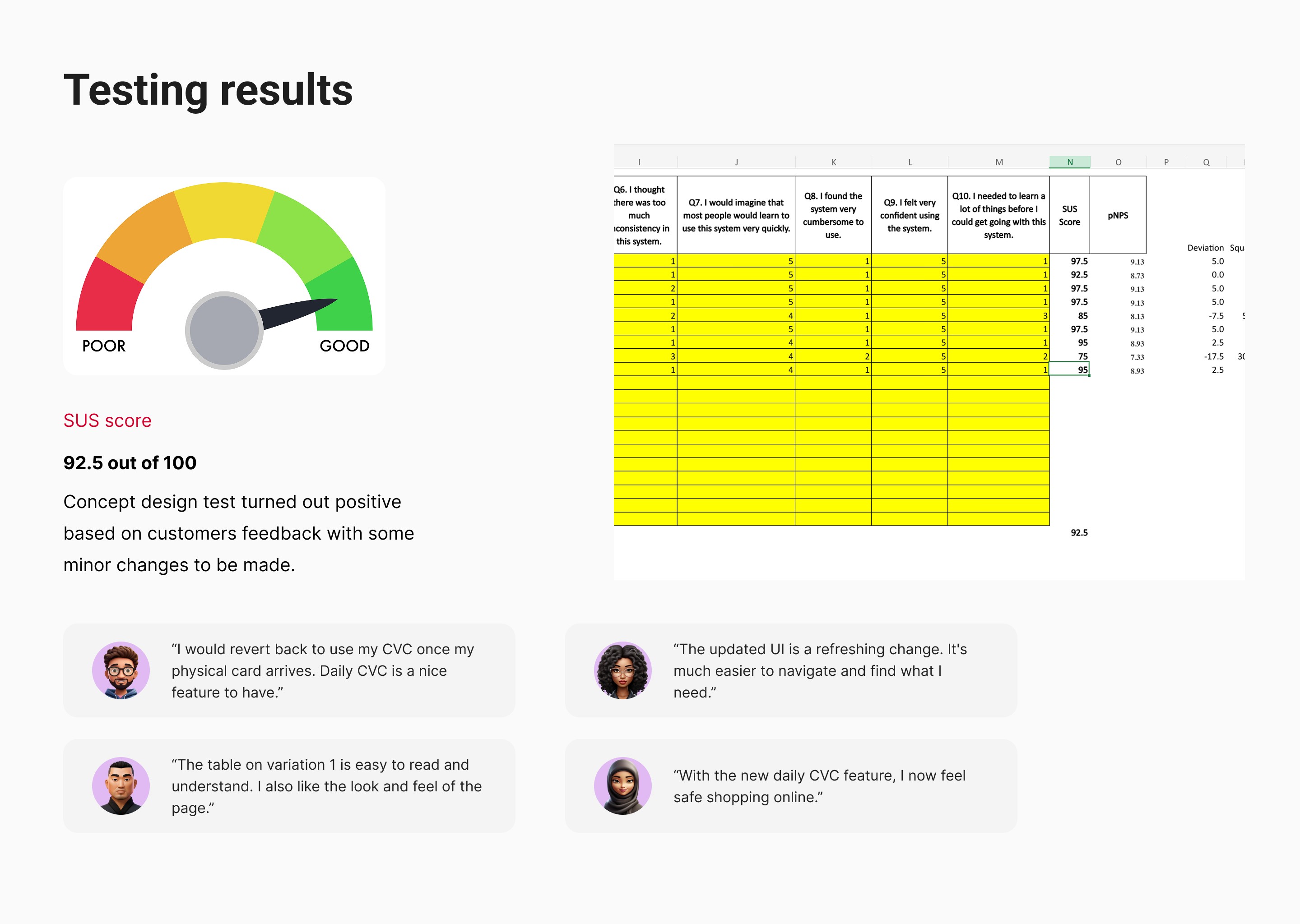

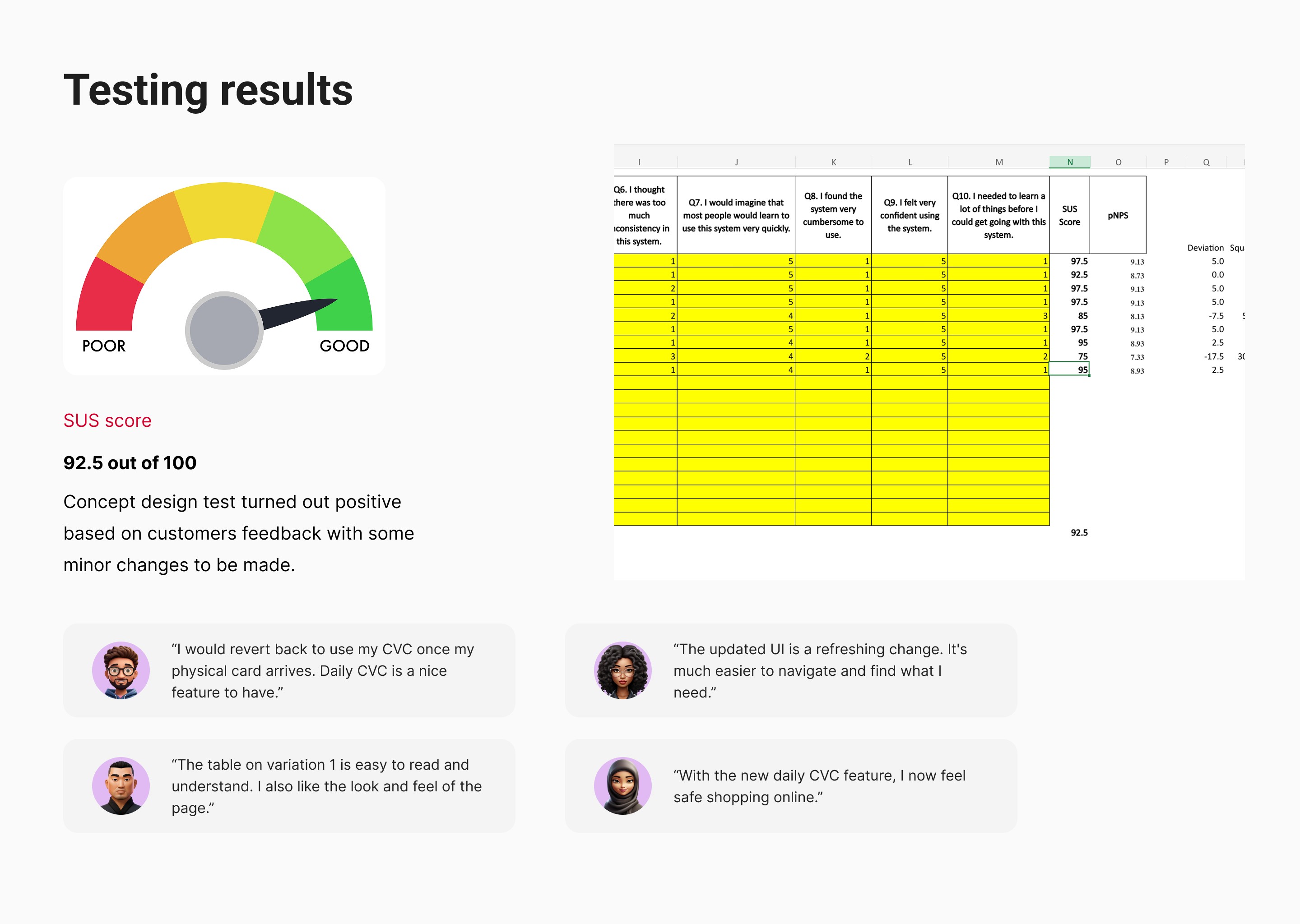

Results

SUS score: 92.5 / 100

Customers reported:

Increased confidence shopping online

Faster access to card controls

Strong trust in the daily CVC security model

Outcomes

Impact

Customer Impact

Customers can transact immediately after card approval

Reduced anxiety around scams and online fraud

Faster access to essential services (e.g. prescriptions)

Business Metrics (Post-Launch Measures)

Reduction in card-related contact-centre calls

Increase in digital card adoption

80% uplift target in Cards section usage via improved bottom navigation

Improved NPS and market competitiveness within NZ banking

Reflection & What’s Next

What I learned

This project showed how early collaboration with security and engineering helps avoid rework later, while using call-centre data kept design decisions focused on real customer and business needs. Clear, consistent communication with stakeholders built trust and momentum, reinforcing that constraints can actually improve design and that strong collaboration is key in regulated environments. Next, the focus is on continuing the phased rollout of Cards Hub improvements and applying digital-first patterns to other high-support customer journeys.

Redesigned the Cards Hub with Digital Instant Issuance to enable faster, safer card access and reduce customer support dependency.

Company

Westpac

Timeline

2023

—

2024

Role

Lead UX Designer

Problem & Opportunity

The Challenge

Cards Hub discoverability

Card controls were buried under the More navigation and implemented as a web view

Customers needed multiple taps just to reach basic card management actions

Delayed physical cards

New customers waited up to 10 working days for a physical card

During this period, customers couldn’t shop online and were exposed to scam risks

Business Impact

High call-centre volume for card-related enquiries

Increased branch visits and frontline staff workload

Opportunity

Native the Cards Hub to improve speed, visibility, and usability

Enable digital cards (Apple Pay / Google Pay) with enhanced security so customers can transact immediately and safely

Leadership & Strategy

Stakeholder Alignment & Discovery

End-to-End Design Leadership

Owned the project across the Double Diamond: discovery → definition → delivery

Provided fortnightly updates to senior leadership to align on progress and trade-offs

Cross-Functional Collaboration

Partnered closely with:

Security & Architecture to validate authentication and fraud controls

Customer Support to ground decisions in real call drivers

Engineering to ensure designs were feasible within platform constraints

Design Practice & Team Enablement

Established weekly designer collaboration sessions to address mobile inconsistency

Encouraged shared critique and design-system contribution

Mentored junior designers with hands-on project ownership and feedback loops

User-Centred Research

I combined quantitative analysis of top call drivers with qualitative insights from customer calls and frontline staff to identify cards as a high-impact support issue, then validated solutions through competitor analysis of leading financial products (e.g., Revolut, Monzo, Wise), uncovering proven patterns such as card-first navigation, instant digital access, and clear, secure card details.

Iterative Prototyping & Testing

Cards Hub Redesign

Reduced card access from 3+ taps to a single, direct entry point

Reframed the Cards Hub as a control centre, inspired by iOS Control Center and Android Device Controls

Prioritised speed, clarity, and one-handed use

Digital Instant Issuance

Enabled customers to:

Add cards to Apple Pay / Google Pay immediately

Shop online safely before physical card arrival

Security-Driven Iteration

Ideal concept: Face ID–only access to card details

Constraint: Security team required stronger safeguards

Final solution:

Secure 6-digit in-app authentication

Daily rotating CVC (unique in NZ market), increasing fraud protection and customer confidence

Design System Contribution

Developed new UI components and standards in the RED design system to maintain consistency and scalable design practice.

Key UX Solutions

Enhancements Included

Research Setup

9 customers over 2 weeks

Balanced gender split, mixed age groups

Users from multiple NZ banks (ASB, ANZ, BNZ, Kiwibank, Westpac)

Results

SUS score: 92.5 / 100

Customers reported:

Increased confidence shopping online

Faster access to card controls

Strong trust in the daily CVC security model

Outcomes

Impact

Customer Impact

Customers can transact immediately after card approval

Reduced anxiety around scams and online fraud

Faster access to essential services (e.g. prescriptions)

Business Metrics (Post-Launch Measures)

Reduction in card-related contact-centre calls

Increase in digital card adoption

80% uplift target in Cards section usage via improved bottom navigation

Improved NPS and market competitiveness within NZ banking

Reflection & What’s Next

What I learned

This project showed how early collaboration with security and engineering helps avoid rework later, while using call-centre data kept design decisions focused on real customer and business needs. Clear, consistent communication with stakeholders built trust and momentum, reinforcing that constraints can actually improve design and that strong collaboration is key in regulated environments. Next, the focus is on continuing the phased rollout of Cards Hub improvements and applying digital-first patterns to other high-support customer journeys.